My wife and I started our emergency fund a decade ago, and it’s provided us a lot of financial peace of mind. Back when we started, we wondered how does an emergency fund protect your wealth?

An emergency fund protects your wealth by helping you avoid going into debt to cover unexpected expenses, or cashing out or borrowing from retirement accounts potentially incurring fees and penalties. It can also protect you against foreclosure in the event of job loss.

But there’s a lot more to know about emergency funds and how they protect your hard-earned money.

So in this article, we’re diving deep into the world of emergency funds. We’ll examine the who, what, where, when, and why. But we’ll also get specific on how much you need and if a regular savings account is the best place to park it.

We’ll also talk about what really constitutes an emergency and how quickly you should build an emergency fund. Lastly, we’ll even touch on how much might be too much in your account. After all, every dollar in your emergency fund is a dollar you aren’t using somewhere else.

Let’s get started!

Need a little help with a current emergency?

If you’re in the situation where you think a personal loan might make sense to consolidate credit cards, pay off student loans, or take care of some much-needed home repairs, the folks over at HonestLoans make it easy to get the best offers in under 2 minutes.

Even as little as a hundred bucks.

You could possibly save thousands a year and you have nothing to lose in checking! It doesn’t even ding your credit score to look at the offers!

CLICK HERE to see how much you can borrow! Apply in seconds and often, you can get the funds in your bank within 24 hours.

Emergency Fund

***a short and sweet thread*** pic.twitter.com/L00tKu8JIl

— SYKY (@SYKY_ID) August 31, 2020

What is an emergency fund?

An emergency fund is a savings account you have money in set aside for emergencies only. It’s in addition to your checking account and main savings account, removing the temptation to use it for non-emergency expenses.

After all, when it’s just sitting there in your main bank account, we have a tendency to spend it!

If you’ve ever experienced any of the following, then you know why having an emergency fund is a good thing:

- You or your spouse unexpectedly lost your job

- A family member incurred a lot of medical expenses not covered by insurance

- You were in a car accident and incurred damage not covered by insurance

- Your home’s AC system suddenly broke beyond repair (or needed a costly repair)

There are a million other possible reasons an emergency fund protects you and your wealth, but those are among the biggies.

As for how it protects your wealth, we’ll get into that in the next section.

🚨Savings vs Investing🚨

I’m all for an emergency fund sitting in a savings account.

But other than that, it just doesn’t make sense.

Don’t be like Chuck,

Be like Joseph.

PS: 0.5% on a savings account is generous.

— Chris | Money Savvy Mindset (@MoneySavvyMind) September 19, 2020

What are the benefits of having an emergency fund?

The primary benefit an emergency fund gives you is peace of mind. But it also prevents you from using credit cards or bank loans to cover unexpected expenses. It can also reduce money fights and financial stress in marriages.

By that, I mean that you and your family know that no matter what financial challenges life throws at you, you have enough cash easily accessible to stay afloat.

Without an emergency fund, if one of the above scenarios happened, what would you do?

If you’re like most Americans, your household carries an average personal debt of $38,000 (that’s not including a mortgage). That’s according to CNBC.

Beyond that, they say that 2 out of every 10 Americans spend between 50-100% of their paychecks just paying off debt.

So if you have an emergency and have no emergency fund, guess what?

To avoid bankruptcy you might well have to take on more debt to cover the unexpected expense, only adding to your overall debt and stress.

So having an emergency fund helps you avoid going deep in debt.

Or if you have a total loss of income due to job loss, an emergency fund might be the only thing protecting you from foreclosure; that’s the ultimate way it protects your wealth.

If you’re married, it also helps you avoid what is often one of the top reasons for divorce. Learn more about those reasons, including the surprising ways too much debt can lead to divorce in a recent article that breaks them down.

But beyond debt and money fights and stress, there are some other benefits of having an emergency fund, such as:

- You are a homeowner – Owning a home is a great way to build wealth. But it requires a lot of upkeep and maintenance, some of which may crop up quickly and surprisingly

- If you are self-employed – Being your own boss is great, but the downside can be inconsistent income

- You know you will have large medical expenses in the future

- You or your spouse stays home with the kids – Being a SAHM or SAHD is great for the kids. But one of the downsides of having only 1 income stream is that everything is dependent on that 1 source of money

Once you learn why an #emergencyfund is so important, you might be motivated to start one. #moneymatters https://t.co/8AeWHrk1xb pic.twitter.com/e2eYgm8p1E

— Sandra Arciniegas (@Sanarci14) September 29, 2020

How much money should you have in an emergency fund?

All the experts say you need between 3-6 months of your monthly expenses in your emergency fund. Add up all your bills for 1 month including rent or mortgage, utilities, debt payments, food, and gas. Multiply by 3 for a two-income household, or up to 6 for one-income or irregular salaries.

Note that 3 months of expenses is NOT the same thing as 3-6 months of your income.

To factor your monthly expenses, start with a budget. If you aren’t on a budget yet, that’s the best place to start. A budget helps you break down and see exactly where all your hard-earned money is going each month.

Trust me, that’s way better than getting to the end of the month wondering where it all went.

If you need help getting started on a budget, check out a recent article where I break down step-by-step exactly how to get started budgeting. I even give you a free copy of my Excel budget spreadsheet.

That’s the same spreadsheet my wife and I use to this day and used to pay off over $60,000 in debt. Or just CLICK HERE to grab a free copy of my spreadsheet now.

So what are your monthly expenses?

- Rent or mortgage

- Electric bill and other basic utilities

- Water bill

- Gas for your vehicle(s)

- Food (not Starbucks every day or Golden Corral every weekend, but essentials)

Think of it this way. If you or your spouse suddenly lost your job and the other spouse doesn’t work outside the home you’d cut out all the frivolous stuff, right?

You’d cut out expensive cable TV for sure, and eating out. You’d want to keep internet service as that could help in job hunting. You would also cease all vacations, trips, boys/girls night outs; this is survival mode!

It’s back to basics until order is restored. But the basic essentials are your monthly expenses.

So why would you want to only have 3 months of expenses in your emergency fund?

You only need 3 months if you and your spouse both work full-time. AND if those jobs are ones you’ve held for 3 years or longer. It also helps if you work for some large nationwide company (like when I worked for Whole Foods, for instance).

Not that large companies can’t go bankrupt. But with large, especially publicly held (as in traded on the stock market) companies, they are held to such scrutiny and often in the media, you tend to easily know if things aren’t looking good well in advance.

If you work for a mom and pop type operation, who knows how well they are managing their money, if they’ve decided to give the business to their kids (who might run it into the ground) or if they are ready to retire?

Essentially a 3-month emergency fund is for 2 stable incomes that aren’t likely going anywhere but up. If that’s your situation, 3 months works great.

The average American household makes $61,372 per year, according to the US Census Bureau.

So if that sounds close to your family, then most likely if you are doing the 3 months of expenses, you probably want somewhere around $10,000 in your emergency fund.

But let your budget tell you the real numbers; I don’t know your situation.

Saving at least 10% of your income is a good rule to follow when building an #emergencyfund. #finances https://t.co/i9qJuk5MtH pic.twitter.com/rBuxc5RCYq

— Jacobo (@Jacobochemist) October 1, 2020

How much should I put in my emergency fund per month?

Plan to put at least $500 per month in your fund until it’s fully built. If you’re starting from zero, you want to get $1,000 in your emergency fund with 8 weeks. Then ideally build your full 3 to 6 months of expenses emergency fund in the shortest time possible. In most cases, get the fund built in under 12 months.

$1,000 won’t cover your homeowner’s insurance deductible for a new roof in the event of hail damage.

But it will cover a lot of small things until you get it fully built. And it will give you some much-needed pteace of mind as you get everything else in order.

So if you don’t have anything saved yet, I would try and get to $1,000 within 2-3 months tops. But of course, that will depend on your income and your spending.

Then, once you’re at $1,000 in there and hopefully on a written budget every month, you’ll need to decide how much you want in your emergency fund in total.

As I mentioned above, for 3 months of expenses for an “average” American family making around $61,000/year, somewhere around $10,000 is about right.

Of course, the faster you get there, the sooner you can breathe easier and focus on other important goals like:

And when you’re ready to do those things my links above take you to my best posts on those subjects that walk you through how to get started on each one.

But for now, if I was in your shoes, I would try and put a minimum of $300/month into my emergency fund. Assuming I already had the $1,000 and my goal was $10,000, that will take you about 2.5 years to get to.

For me, that’s probably too long and I would try and work my budget to allow for $500/month. $500 each month will get you there in 1.5 years which just makes me feel a little better.

If you’re serious about building an #emergencyfund, an extra job can help you do it. #moneymatters https://t.co/jkcpTiHHG5 pic.twitter.com/MSi4EIuEGh

— Mike (@mikeUGMT) September 29, 2020

How much is too much emergency fund?

Don’t put more than $25,000 in an emergency fund unless your income is well over $250,000 per year. The biggest issue with putting more than that is it’s not earning much interest.

Let’s say that you make the average US household annual income of $68,700. (source) In that case, you probably want a maximum of $17,500 in your emergency fund if you’re doing 6 months of expenses.

Anything over that is overkill in my opinion.

After all, as we’ll get into below, this ISN’T investing. You aren’t earning any significant interest off of this. This is money you hope to never spend that’s just there for when Murphy comes calling on a rainy day.

Because of that, once you have a comfortable level in your emergency fund, I want you to then focus on saving for retirement and investing to build wealth.

AND having that emergency fund in place PROTECTS that wealth that you will build. But in and of itself, the emergency fund is NOT wealth; it’s protection.

Should I put my emergency fund in a money market account or CD?

No, you should not put your emergency fund money in anything other than a savings account. This is not an investment, but instead, money set aside for unexpected large expenses. It needs to be accessible when you need it, but not in a primary checking or savings account where the temptation to spend it is high.

An emergency fund is not an investment; in fact, the primary goal is to protect you and your wealth. After all, without an emergency fund, you’d have to either borrow money or tap into your 401k or other investments.

When we do any of those things we are sabotaging our wealth and our long term financial future.

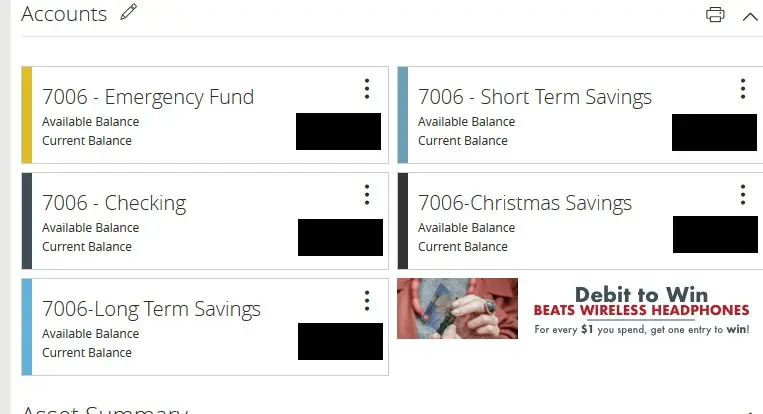

So this money needs to be accessible (but not so accessible you are tempted to spend it). What my wife and I do is we have 5 bank accounts.

Here are the 5 bank accounts we have:

- Checking

- Christmas Savings

- Short-Term Savings (for things like an upcoming vacation or annual expenses like car registration)

- Long-Term Savings (like if we know we will need a new roof in 4 years)

- Emergency Fund

They are all in the same bank, which makes it easy to transfer money from one to another. But since each of those financial goals are different, it really helps to keep them separate.

I have a recent article which goes into a lot more detail about why we have those, how we use them, and how they help us save money.

What really surprised me was how separating those out into individual bank accounts enabled us to save money almost twice as quickly! So click the link to read it on my site and see how it can help you.

Determining how much you want to save is the first step in building an #emergencyfund. #personalfinances https://t.co/B3Yp2scrDb pic.twitter.com/kJkZDK5ECT

— RE/MAX Jefferson City (@cit_re) September 30, 2020

How is an emergency fund similar to and different from a savings fund?

An emergency fund is a savings account. However, unlike saving for Christmas, a new car, or a vacation, an emergency fund is only used for large unexpected expenses of over $1,000 where you would otherwise suffer hardship if you did not have the money.

As I mentioned above, our emergency fund is one of 4 savings accounts we have.

So, from a technical standpoint, there is no difference. I just went to our bank and asked to open 3 additional savings accounts. But to really get traction, it is crucial to have each type of savings account be separated from one another.

Another key step was to name the accounts.

After all, if you pull them all up on your screen and you just see account numbers, it’s hard to know which one is which. So I just told the bank what I wanted to name them and it made it really easy. Here’s a screenshot of our actual bank accounts:

Now to be fair, the Christmas savings account is slightly different in that the bank automatically transfers the full amount in there back to our checking account on November 1st.

If you don’t have a Christmas savings account, you’re definitely missing out!

My wife and I used to scramble every holiday season to find the money to buy gifts, do extra travel, and host lavish holiday meals and parties. Ultimately what would end up happening is it would all go on the credit cards.

Then the bills would hit in January and we’d wonder what the heck just happened?

Nowadays we just set aside about 90 bucks in our Christmas account every month starting in January. By the time November rolls around, we have almost $1,000 to spend for the holidays; no sweat, no stress, and (most importantly) no debt!

If you want to get started on setting up your holiday savings account, just go to my recent article that walks you through, step-by-step, on exactly how to do that.

Just click that link to read it on my site.

Dave Ramsey’s Baby Step One – Get $1,000 Emergency Fund in the Bank – #babystep1 https://t.co/ozn3yp5rhE pic.twitter.com/lueJFf51t7

— Money Q&A – Hank Coleman (@moneyqanda) August 11, 2018

What should an emergency fund cover?

An emergency fund should cover unexpected expenses such as:

- A new motor or transmission

- The homeowner’s insurance deductible for damage done to your home

- Large medical expenses that were unexpected and not covered by insurance

- If you have to replace the HVAC system on your home unexpectedly

Well, let me also tell you what an emergency fund is NOT for.

An emergency fund isn’t for any of the following:

- Annual auto registration

- Property taxes

- Income taxes

- Holiday spending

- Vacations

- A new roof

After all, NONE of those things are completely unknown.

The taxes would be the least predictable, but even then if you owed the year before and didn’t adjust your withholding allowances, then it’s a pretty sure bet you’ll owe again this year.

No, those expenses are known expenses.

Even a new roof isn’t an emergency as, unless it’s from storm damage (and typically covered under insurance) you can see the condition of your roof and anticipate when it will need to be replaced.

That means you can start to set money aside for it before it’s time to replace it.

While we pay them irregularly rather than monthly, we KNOW those bills are coming. If they sneak up on us, it’s just because we don’t have a good system of keeping track of them.

What I do is use an online to-do list I can pull up on my phone or computer. I personally love using the app GQueues which is free for desktop and something like 5 bucks a year for the mobile app.

I actually have a review and complete tutorial on it, so if you’re interested, just click the link to read it on my site and see if it might just be the solution you’re looking for!

But I don’t just have a reminder for those bills when they are due. I actually have the reminder crop up a few weeks ahead of time so I can budget them in.

Now for property taxes, I actually prefer to escrow those in with my mortgage payment. But if you didn’t do that or don’t want to do that, I would actually divide the annual bill by 12 and put that amount aside every month in my short term savings account.

A true emergency is something large, unexpected, and costly, such as any of the following:

- To cover monthly expenses in the event of job loss

- A large out-of-pocket medical bill

- Your HVAC system breaks and needs to be replaced

- You have a major unexpected auto repair

So obviously, you’ll use your best judgement, but if you go down the road of spending it regularly on things that aren’t really emergencies you’ll find yourself always struggling to fill it back up, and never quite get ahead.

Fill it up, and don’t touch it except for true emergencies.

Final thoughts

In this article, we took an in-depth look at the world of emergency funds.

We explored why you need one, how to start one, and how much you need to keep your family finances safe and secure.

Ultimately, we answered the question of how does an emergency fund protect your wealth.

Need a little help with a current emergency?

If you’re in the situation where you think a personal loan might make sense to consolidate credit cards, pay off student loans, or take care of some much-needed home repairs, the folks over at HonestLoans make it easy to get the best offers in under 2 minutes.

Even as little as a hundred bucks.

You could possibly save thousands a year and you have nothing to lose in checking! It doesn’t even ding your credit score to look at the offers!

CLICK HERE to see how much you can borrow! Apply in seconds and often, you can get the funds in your bank within 24 hours.