Trying to figure out how to budget when you don’t have enough money to pay the bills is tough! My wife and I have been there, and we figured out how to budget when you are broke.

To budget when you’re broke, identify if you have an income, spending, and/or debt problem. Then prioritize bills, delaying payment on the least important if necessary. Start to assign each dollar in income a specific task in your list of expenses and have a long-term plan to address any low salary issues.

But there’s a lot more to know about how to budget when you’re broke.

So let’s dive into the exact process my wife and I took to get from well over $80,000 in debt and monthly household expenses that greatly exceeded my income to where we are today.

Today we have no debt, save for retirement, college savings for our 3 daughters, go on decent vacations, and recently bought our (somewhat modest) dream home.

If we can do it, I know you can too!

In over your head? Find Your Best Personal Loan Option can help!

If you’re in the situation where you think a personal loan might make sense to consolidate credit cards, pay off student loans, or take care of some much-needed home repairs, the folks over at HonestLoans make it easy to get the best offers in under 2 minutes.

Even as little as a hundred bucks.

You could possibly save thousands a year and you have nothing to lose in checking! It doesn’t even ding your credit score to look at the offers!

CLICK HERE to see how much you can borrow! Apply in seconds and often, you can get the funds in your bank within 24 hours.

You’ll start that diet tomorrow.

You’ll make a budget tomorrow.

You’ll focus on your own happiness tomorrow.

But the problem is…it’s always today. pic.twitter.com/oIPXkpWMI7

— Matt Altobell (@mattaltobell) August 25, 2021

How do you start a budget with no money?

I won’t lie. If you’ve never tried to write a monthly household budget before, it’s a little tough at first.

After all, we weren’t likely taught it in school and most likely our parents didn’t use one either. So it feels foreign. Any time something is unfamiliar, it takes time doing it before we get comfortable.

Whether that’s riding a bike without training wheels, learning to drive a car or budgeting, they all feel uncomfortable at first.

The key is to have the drive and motivation to push past that. You have to be sick and tired of feeling sick and tired or it won’t work. In other words:

Your desire to learn how to budget when you’re broke and to eventually get to where you aren’t broke has to be stronger than your desire to only do things that are familiar or comfortable.

The good news is a budget doesn’t have to be complicated. No, it simply:

- Takes your total monthly income

- Subtracts your known monthly expenses

- Ideally gets you to zero by the end of the month

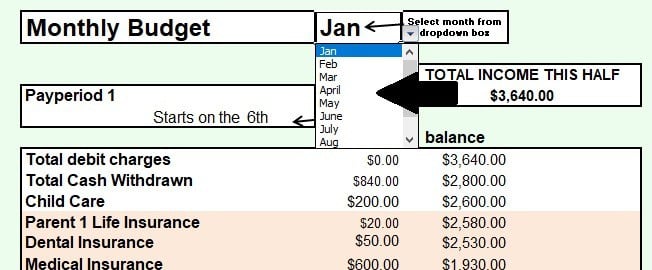

Below is a quick look at my Monthly Budget Spreadsheet (click to download now for free).

I simply select the month the budget is for (I usually am working on the budget 2 months ahead of time, but 1 month ahead is fine).

Then I plug in my known projected income for the month (I get paid every other Friday, so my monthly budget is split into 2 sections) and then my known projected bills and expenses.

The spreadsheet automatically gives me a running balance to the right, so I know if my budget balances at the end of the month or now.

The key to getting started isn’t to wait until you have everything under control.

After all, the fact that you don’t have a budget (at least a working one) is why you’re here trying to learn how to budget when you’re broke). So get started today!

It won’t be perfect at first and you will make mistakes, but the sooner you get started, the sooner you’ll get to a place where you AREN’T broke and struggling to make ends meet.

Now, I don’t care if you use my budget spreadsheet or not.

There are some Great Budget Apps (click to see my article on the 9 best ones) and many of those are free or have a free option. But you could also use a piece of paper if you like.

The KEY is simply to get started.

Here’s a quick video I made that walks you through the basics of getting started on a budget.

How can I stop being broke anymore?

When you’re broke you either have an income problem, a spending problem, or a debt problem (or maybe all 3).

So let’s examine each one individually:

Budgeting challenge #1 – Fixing an income problem

According to the US Census Bureau, the average salary in the US is $56,516 and the median household income is $61,372.

So right out of the gate, if you make less than $56k or if you have a wife and/or kids and the total household income is below $61k, you have an income problem.

Of course, even if you do make those, if you live in someplace like New York City or in California, you probably still have an income problem.

The good news is you’re probably not officially at the poverty level.

The Poverty Guidelines for a family of four is an annual household income of at or below $25,100 for most of the US, $31,380 in Alaska, and $28,870 for Hawaii.

But if you have an income problem, while we can still get you budgeting, we have to address your income for long term success.

Here’s what I did to boost our income when we were in that boat.

1. Look at your current job and what the long-term career potential is:

- Is it a dead end job or is there an opportunity for advancement?

- Do pay and benefits naturally get better the longer you stay?

- What does the company pay employees with 5+ years of service?

- Does the company reward employees for hard work or just churn through a bunch of minimum wage workers?

2. Consider a career change if the answers to those questions are not good:

- Many of us find a job purely out of necessity, but there’s no harm in eventually realizing we’re worth more than what they are paying us

- If your long-term goals and visions don’t match up with how the company operates, there’s no harm in that and it doesn’t make them evil, but it does mean you need to be focused on what else is out there

- I don’t recommend changing jobs frequently as that can damage your reputation as a reliable employee, but you do need to find a job you love that can at least pay you the average salary in the US

3. Look at training or certification options to boost your earning potential:

- Sometimes it’s not as simple as just finding a new employer

- So when it makes sense, consider classes at a community college, trade school or apprentice program to add skills and certifications to your resume IF they are proven to boost earning potential (check with friends and scour the internet to see)

4. Consider adding a side hustle:

- Sometimes YOU are your best resource and doing something on the side is the best way to boost your income

- For example, I make a few thousand dollars a month from my blog and you could easily do that too! Check out my detailed guide on How to Build a Website Step by Step (click to read on my site) to follow the exact steps I did on a shoestring budget in 2016.

- 53 other side hustles – But if the idea of blogging doesn’t sound like a good fit, I compiled a list of 53 of my favorite ways to Earn Extra Income on the Side (click to read my post) and I bet at least a few of those could work for you!

Once you have a plan for boosting your income then just get about to doing it. Just imagine if your budget could get an extra $1,000/month from one of those changes?

Budgeting challenge #2 – Fixing a spending problem

A spending problem is arguably the easiest to fix here.

When we have a spending problem it usually just means we don’t have a plan. We aren’t being intentional with our money and our spending choices and our habits.

Getting on a budget is the easy fix for this.

The budget simply takes all the money you make and gives each dollar an assignment. And sure, when you’re NOT broke, some of those assignments can include a clothing allowance for you or your spouse, pocket money or money for a night out with friends every week or so.

But for right now, we’re NOT doing those things.

I want you to be laser-focused on not being broke, getting started budgeting, and then starting to plan for the future.

Once you have your budget (and don’t worry, I walk you through that step-by-step below) then you only spend what’s on the budget and you and your spouse (if you have one), agree to follow it to the letter.

Sometimes, though, it’s not us with the spending issue, but our spouse.

If you have a Spouse with a Spending Problem (click to read my article), I highly encourage you to check out my post on the RIGHT way to deal with that.

Trust me, done wrong, you’re well on your way to defensiveness, name-calling, and anger-binge shopping.

Budgeting challenge #3 – Fixing a debt problem

A debt problem is arguably tied to both a spending problem AND an income problem. After all, if you were living below your means, on a budget, and not impulse purchasing, chances are you wouldn’t have a debt problem.

But relax. I’m not here to judge, because I’ve done all of those things too.

I AM here to tell you there’s a better way though. In the US as a whole right now, we have a HUGE problem with debt (and not just the government’s insane $22 trillion dollar debt).

The average American has an average of $38,000 in debt, not counting home mortgages.

That’s according to Northwestern Mutual’s 2018 Planning & Progress Study. They go on to report that the number of people with no personal debt is going down, from 27% to 23%. That means an incredible 77% of Americans use personal debt to make ends meet. Ultimately, that’s just not sustainable.

Why is using credit cards to make ends meet each month not sustainable?

Well for one, what happens if you lose your job? Or maybe your employer falls on hard times and cuts you back from full time to part-time?

If your salary shrinks, those credit card bills don’t. And if your household budget has come to rely on them, then that will only increase if your income goes down. But eventually, you’ll max them out and won’t be able to simply get another one.

No, you MUST learn to live on what you make and if you don’t like what you make, get fired up to change that.

Another good example is a car ad I heard on the radio the other day. This guy is always on the radio in the Austin area pushing his used car dealerships (despite his terrible Yelp and BBB reviews). He said, “if you take home $400/week, you can qualify for a $25,000 car!”

$400/week take home amounts to about $502/week gross or an annual income of $26,104.

As I mentioned above, that is just a HAIR above poverty level! The last thing a person who is basically living at the poverty level needs to be doing is driving a $25,000 car!

They should be taking the bus, walking, or riding a bike until they get their income problem fixed.

But that’s life in America and a great example of how and why we have such a massive debt problem. People think that just because they can qualify for the loan, that means they can afford it. And that’s just not true.

Plus the lenders (in some cases), have government-backed programs to protect them from people who can’t pay what they borrowed AND they will send (often) unethical collection companies after you too.

The only people who lose in this game are those of us who borrow money on things we can really afford.

How do you survive a low-income budget?

The key to surviving anything that requires sacrifice is:

- Having a clear goal that makes the sacrifice worth it

- Being able to clearly see the end result

- Knowing the estimated timeline to get to your goal

If you don’t know any of those things and are just struggling, that’s when we do dumb things (been there, done that).

We make poor financial (and otherwise) decisions because we can’t see why the sacrifice will eventually be worth it.

So yes, to get ahead financially, get out of debt, get on a balanced budget and begin to save for things like retirement, pay for vacations without credit cards (or heck, even just take a vacation), you are going to have to sacrifice now.

But that’s just temporary.

So to survive right here and now on a budget when you’re broke you’ll want to find ways to cut costs across your whole budget, including things like:

1. Cut the cable

If you have expensive cable TV eliminate that too and get the top-rated digital antenna from Amazon for under 30 bucks.

Or get a Roku Stick (click to see the current price on Amazon) and stream Amazon Prime, Netflix, Hulu (click to sign up on their site), and other similar channels.

Don’t have Amazon Prime? It’s got tons of channels, movies, and TV shows. Try Amazon Prime free for 30 days (click to sign up on Amazon)! You’ll also get their famous free 2-day shipping on all qualified purchases.

2. Pause contributions to retirement savings & kid’s college

These are great things to be contributing to, but only once you’re out of debt, on a balanced budget, and are well on your way to long-term financial success

3. Pay cash for all but your recurring monthly bills

My wife and I follow Dave Ramsey’s Envelope System (click to read my detailed article).

What we do is take out cash each payday (an amount we agreed when we wrote our budget). Then we simply divide that cash up among different category envelopes (groceries, gas money, both spouse’s personal spending & family spending).

If we use all the money in 1 envelope, then it’s gone until the next payday.

Spending cash rather than using credit or debit cards WILL cause you to spend less, and right now that’s the name of the game!

This is what a (former) CEO looks like. Only did it because had to support these two on one salary. Hard work as a single mum but I’m so proud of them and us as a family 😍 pic.twitter.com/vin27og2MI

— ✨ Prof Donna Hall ✨ (@ProfDonnaHall) October 4, 2020

How do people survive on one salary?

My wife and I survive on one salary!

While that hasn’t always been the case, and she may go back to work as a teacher once our youngest daughter Layla enters kindergarten, we do currently operate on just my salary and have done that on and off for most of our marriage.

The key to making that work is:

- Get paid well – I work a job that pays me what I’m worth

- Side Hustle – If I couldn’t find a job like that I would do some side hustles until I could find one

- Budget – We make a budget each and every month and have for almost a decade at this point

- Control Spending – Then we simply spend less than we make

What bills are most important to pay?

If our expenses exceed our income, then something has to get cut, so we prioritize our expenses as follows (most to least important):

-

- Main utilities (electric, water, etc)

- Groceries

- Insurance (life, auto, and health)

- Gas for the cars (to get to work, cutting out frivolous trips)

- Cell phones

- Medical bills

- Personal spending/eating out

We don’t have or use credit cards, but if you do, they would go towards the bottom of the pile right above medical bills.

Make paying off debt a priority in order to save money on a tight budget. #debtfree #goals https://t.co/1jmbHHfEpj pic.twitter.com/PzXbzF1IIl

— Richard Markussen (@RickRealtor2) September 2, 2021

How do you pay bills on a tight budget?

When you’re broke but the bills are still coming in, you have a few decisions to make.

After all, if your monthly income is, for example, a net pay of $3,000 and your bills (including rent or mortgage, utilities, groceries, etc) is over that amount, something has to get cut or shrunk.

If you’ve already looked at your spending and income issues I addressed above, then we have to get about prioritizing your bills. I get into this a little bit in the section immediately above, but let’s examine the prioritization in greater detail here.

First, things like credit card bills, medical bills (not insurance monthly payments) or any payments to collection agencies need to come dead last.

The reason for that is simple.

If you have to choose something to not pay or pay late, it shouldn’t be your rent or mortgage (don’t want to get evicted or foreclosed on), electricity (can’t focus on the future if you can’t even keep the lights on) and it shouldn’t be basic groceries (but no eating out right now).

Another little secret that credit card and medical bill companies won’t tell you is that if you pay on time, they can’t ding your credit for late payment even if your on-time payment is below their stated minimum payment.

So if you can afford it, pay everyone on-time, but just send them $25/month. They may call and harass you, but they can’t do much about it since you actually ARE paying them on time.

As a matter of integrity and principal, I DO want you to pay what you owe.

But for right now, you have more important things to be working on while you get yourself out of the mess and things like credit card bills and hospital or medical provider bills can go to the bottom of the priority list.

Before you start Investing you should:

1. Have an Emergency Fund

2. Buy an Insurance Policy

3. Pay off your high interest debts like credit cards

4. Have a household budget

5. Make a plan to reach your goals

6. Read and learn about Finance

7. Pick your Magic Number pic.twitter.com/46uX7IvXKV— Smart Money Mania (@smartmoneymania) June 4, 2021

How to start an emergency fund with no money

An emergency fund is crucial for your long term financial success.

After all, if your car died and you had to get a new one, could you buy one without going deep into debt? Even if you don’t object to a car loan if you own your home, what if your AC went out or maybe you lose your job?

All of those and host of other things could happen.

After all, life happens and bad things do happen to good people. So the emergency fund is your KEY to protecting your family.

It prevents things like eviction, foreclosure, can put food on the table, and at the very least can prevent you from having to use credit cards and rack up more debt when the unexpected happens.

So how do you add an emergency fund to your budget when you’re broke?

The key, at first, is to start small. Save $1,000 in that fund to start with. That won’t cover a major unexpected expense, but it will cover a lot of minor ones. Mostly, it gives you a little breathing room and reduces stress and anxiety while you’re on the road to financial success.

How do you save $1,000 for your starter emergency fund?

As fast as possible.

Many people hit Starbucks every day on their way to work. If you’re one of those people, simply cutting out Starbucks, even if you just order a drip coffee, could get you your emergency fund in under a year.

Just imagine how quickly you could do it with even a little bit more sacrificing?

Then, once you’re out of debt except for your mortgage, you’ll eventually build it up to 3 to 6 months of your household expenses. There’s a lot more to cover on Emergency Funds (click to read my detailed article).

So my article walks you through step-by-step exactly how to set yours up, including whether yours should be on the 3-month side or closer to the 6-month side.

Use this information to improve your ability to save up for #retirement. #finances https://t.co/1z2McwQ5kq pic.twitter.com/ghTyJ72WTT

— Nicole Lane (Nikki) (@n_lane_homes) September 7, 2021

How can I save for retirement if I live paycheck to paycheck?

In short, you shouldn’t be right now.

Until you are debt-free except for your home, are on a monthly budget that balances, and have a good plan for your long-term career and salary, you should off on, or pause, saving for things like retirement or saving for your kid’s college fund.

Those are GREAT things to be doing, but not when you’re just trying to stay afloat financially.

So have a solid plan to get budgeting, look at the long-term career and salary options if you aren’t where you need to be, and get out of the weeds first.

Then when you’re debt-free except for your mortgage, I want you to start saving 15% of your gross annual income towards Saving for Retirement (click to read my beginner’s guide when you’re ready to get started) set aside each month in a Roth IRA.

If you have school-age kids, at that point you’ll want to start saving for their college tuition too.

After all, the last thing you want when getting your financial mess cleaned up is to hand one to them in the form of student loans.

44 million people currently have an average of $37,172 in student loan debt.

When you go back to the average salary in the US I mentioned being $56,516, it’s not hard to see that’s an awful lot of debt for that low of a salary. So help them out when you’re in good financial shape by reviewing How to Save for Your Kid’s College (click to read my tutorial).

Lastly, I want you to download my FREE Excel Budgeting Spreadsheet (click to get it now) to get started on your budget today.

Then simply review my video here which walks you through setting it up.

Final thoughts

Being broke and trying to figure out how to budget and plan for the future when you can barely pay the bills is tough!

I remember those days and I KNOW there’s a better way (because my wife and I found it).

In this article, I walked us through exactly what to do to stop being broke, to get started budgeting, to find the motivation to continue when you’re struggling, and so much more.

Don’t forget to grab a free copy of my Monthly Budget Spreadsheet (click to download now for free). That’s your blueprint to getting started and it will be in your inbox in minutes!

Learning how to budget when you’re broke isn’t rocket science. It’s also doesn’t require some skill only a few possess. You CAN learn how to budget and get to a place where not only are you NOT broke, but you’re actually saving and thriving.

It’s not an overnight process.

After all, any time we find ourselves in a mess, it usually took some time creating the mess. So it will take some time to clean it up too. But it CAN be done.

You just need a little time, effort, and focus, AND the right road map to follow. What has been your biggest challenge with learning how to budget when you’re broke?

In over your head? Find Your Best Personal Loan Option can help!

If you’re in the situation where you think a personal loan might make sense to consolidate credit cards, pay off student loans, or take care of some much-needed home repairs, the folks over at HonestLoans make it easy to get the best offers in under 2 minutes.

Even as little as a hundred bucks.

You could possibly save thousands a year and you have nothing to lose in checking! It doesn’t even ding your credit score to look at the offers!

CLICK HERE to see how much you can borrow! Apply in seconds and often, you can get the funds in your bank within 24 hours.

As an Amazon Associate I may earn a small comission from qualifying purchases if you click to Amazon from my site and choose to make a purchase. You can read my complete affiliate disclosure for more details.