A while back I got turned down for credit on something and it got me thinking about how to increase a credit score to 800.

To get an 800 credit score, pay off as much revolving debt as possible (credit cards, store cards), negotiate debt in collections (requesting credit entry removal upon payment), don’t take out any new loans & don’t give out your social security number (which can temporarily lower your score if used as a credit inquiry).

Is a credit score some mythical thing you have no control over?

No, is the short answer. While it’s true you can’t directly influence it, there are a number of things you can do to improve it. The good news is there are tips on how to increase your credit score to 800.

After all, most financial messes take a while to make, so cleaning them up quickly won’t be easy. In this post, we’re looking at the proven ways on how to increase credit score to 800.

Rather just pay a reputable company to fix your credit for you?

I get it! You just want to live your life, enjoy your family and friends, and build a future. And you don’t want to be dragged down or held back by credit problems.

Luckily, The Credit Pros use the power of AI to manage your credit for you quickly and easily!

And unlike a lot of credit repair companies that are spammy and scammy, The Credit Pros have actually been featured in places like:

- Forbes

- ConsumerAffairs

- Investopedia

You get easy to read credit reports and personalized score insights. Credit monitoring is included also, and the tools and info you need to quickly, easily, and legally improve your credit score.

Schedule a free consultation, or just get started over at The Credit Pros and get started today (just click the link to see all the details on their site).

What is a credit score?

A credit score is a number assigned to you FICO based on data from all 3 of the big credit bureaus (Equifax, TransUnion, and Experian).

Your score is a range of 0 to 850, with 850 being the best. Anything 700 or higher is considered good and anything 800 or higher is considered excellent.

Your score is not a measure of financial success.

After all, if Warren Buffet never borrows money, his credit score would be 0. No, a credit score is a measure both of how much money you borrow and owe, AND how well you do in repaying those debts in a timely manner.

As Dave Ramsey likes to say, your FICO score is an “I love debt” score.

FICO, which stands for Fair, Isaac, and Company is the company that calculates the commonly used credit scores in the USA.

In turn, there are 3 credit reporting agencies that creditors and debt collectors report your history too. As I mentioned, these 3 are Equifax, TransUnion, and Experian.

Because each of the 3 bureaus may have slightly different information, they will all have slightly different credit scores for you.

It’s also possible some creditors you may be trying to borrow money from won’t check your score with all 3 agencies.

Here is a chart of the good, the bad and the ugly in terms of your credit score

So you can see a good credit score is 700 and higher.

So to get into the excellent range you’ll need an increase of at least 50 points. Can you boost credit score overnight? Maybe, but there’s a lot of factors involved.

So how do we do that? Let’s dive in deeper!

How is a credit score determined?

First, let’s review how a credit score is calculated. That way you can see what areas will have the biggest impact.

This is where you’ll focus your energy.

You can see one of the biggest factors is payment history (do you have a long history of paying on time). Since this requires time to prove your creditworthiness, this is not where you will focus your energy.

After all, when you’re wondering how to increase credit score to 800 or how to boost a credit score overnight, you’ll want some faster solutions.

The next biggest factor is your total outstanding debt.

This is looking at both how much your total debt is in relation to your income, but also how much of the available credit you are using.

How does debt affect your credit score?

As an example, let’s say a man making $80,000/year owes $15,000 in credit card debt and pays his bills on time.

If he owes all of that $15k on a credit card with a $16k limit that means he’s used up almost all of his available credit.

If he owed $8k each on 2 different credit cards with $16k limits, he would be well under his total available credit. Thus even though the same man owes the same amount on the same salary, theoretically in the 2nd example he could have a much better credit score.

So when learning how to raise your credit score in 30 days or how to increase credit score to 800, look at where you owe your money and how much you owe in relation to your limit.

While it may not be possible to boost credit scores overnight, you can take certain actions that can cause quick improvement.

If you have maxed out your cards, either pay them down significantly or at least to where you owe less than 75% of the total limit. If you aren’t able to do that call your card companies and see if they will raise your credit limit.

DO avoid the temptation of using the new and improved credit limit. After all, being in debt is NOT where you want to stay.

While you could try and get new cards and do balance transfers, there are 2 dangers there.

- You will be tempted to keep using all the cards, thus increasing your total debt

- Any new line of credit will generate a credit inquiry on your credit score possibly having a small negative impact.

How can I raise my credit score overnight?

Unfortunately, no matter what some things on the internet might tell you, you can’t significantly impact your credit score overnight.

That’s simply too short a period of time.

Could you impact it 20-40 points over a week or so? Maybe. But you’re still at the mercy of many different people none of whom truly care about your credit score.

So when we start with an unreasonable expectation, we’re setting ourselves up for disappointment. So set your sights on a more reasonable goal, be diligent and you can achieve that goal.

That being said, the things within your control that will have the quickest impact on your score include:

- Dispute all errors on your credit report (even little ones)

- Ask any utility companies you have used (and paid on time) to report your payment history to the credit bureaus (phone, cable, electric, gas, etc.) – often these companies do not report to credit agencies (but can)

- Pay down any credit cards so the balance is no more than 75% of the total credit limit (maxing out your limits lowers your score)

- Increase the credit limits on cards you can’t pay down below the 75% range – If you can’t afford to pay down your cards to be under 75% of the credit limit, call them and see if they will raise your limits. If they do, and you now owe 75% or less than the limit, your score will improve

- Ask your creditors (card companies, mortgage companies, etc.) what day of the month they report to credit bureaus. Then pay your bills to them early by that date, regardless of the official due date

- Don’t keep credit cards with 0 balances – Close the accounts or continue to use them and pay them off. Otherwise, a bunch of cards with no outstanding balances can hurt your score

How can I raise my credit score in 30 days?

As with any of these credit score strategies, it’s important to realize that it may not work as well or as quickly as you want it to.

As I said above, there are just too many factors out of your control. Thus if you have a big purchase planned, the further in advance you can start this process, the better.

I go into EXTENSIVE detail in a highly shared post about Credit Report Repair (click to read it on my site), so to dig in deeper or if you know there is damaging info on your credit report, I highly recommend taking a look there too.

The good news is that the moment FICO receives an update they do generally get your account updated within 24 hours.

The bad news is your creditors don’t always report positive information in a timely manner.

Thus anytime you are paying off a debt in collections or past due debts, ask the creditor to guarantee in writing that they will remove any negative entries from your credit report within 24-48 hours of receiving payment.

Get this before you give them your money. Once you pay them you lose 100% of your leverage.

After all; they just want your money. They don’t really care about your credit score.

If they get paid, they’ll be likely to agree to anything reasonable. Just get it in writing (email is fine) and then make sure to pay by cashier’s check or money order only.

Is an 800 credit score good?

Yes, is the short answer.

As you can see above in the FICO graphic, any credit score over 700 is considered good. According to credit reporting company Experian, the average credit score in the US is 675, so 800 is considerably higher than that.

The top end of the credit score chart is 850, so while 800 still has a small amount of room for improvement, 800 is still considered an excellent credit score.

Can you have a 900 credit score?

No, is the short answer.

850 is as high as credit scores go. Especially given most lenders consider an 800 score to be perfect, even if you could get a 900, it wouldn’t likely improve your interest rates on loans, the amount lenders would be willing to lend to you, or the terms of the loan.

Literally, once your credit score gets to 800, that’s usually about as good a deal as you’re likely to get from lenders.

What percentage of the population has a credit score of over 800?

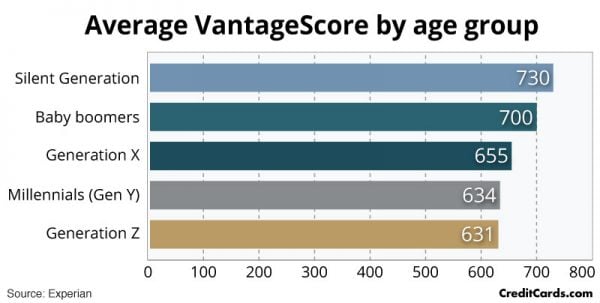

About 20% of the population has a credit score of over 780 which is well into the excellent range. Not surprisingly, the older the person, the more likely they are to have a higher credit score.

So if you’re wondering how to increase credit score to 800, just wait a few years.

The silent generation (age 68 and higher) tend to fare the best, while Millennials and Generation Z tend to fall into the low 600’s.

The reasons for this should be obvious.

As we age we (hopefully) learn how to handle money better. We also tend to deal with past mistakes and are more likely to have paid off things like cars and houses.

We also have a much longer payment history. And if much of that history is good, as we know from above, that impacts 35% of our score.

You don’t need to carry a balance to raise your credit score. You don’t have to make a million dollars to get above an 800. Hard inquiries are not detrimental to your score. Having utilities in your name does not boost your credit score. pic.twitter.com/J9dDqdV9Uk

— Grown Up Gurus (@Grownupgurus) April 11, 2019

What happens if you have a 800 credit score?

If you already own a home and don’t ever borrow money or use credit cards (what my family and I do), then actually NOTHING happens.

All an 800 score means is that you do borrow money frequently and you do an excellent job of repaying it. Believe it or not, if you paid cash for your house and never borrowed money, your credit score would actually be 0.

A credit score is not a measure of wealth or even a measure of financial performance. It is a measure of how much and how well you borrow money.

Now if you do borrow money responsibly, the biggest impact an 800 credit score will have for you will be on lower interest rates on credit cards or bank loans or mortgage rates.

If you already have credit cards, though, you will likely have to ask them for lower rates as they aren’t likely to just lower them automatically.

Is a credit score of 550 bad?

560 is generally where credit scores start to be classified as “bad”. So, 550 or anything below that is a bad credit score.

The good news is it’s not usually hard to raise the score up a little bit from there.

A bad score typically would mean you have debt in collections you haven’t dealt with or paid multiple creditors 30 or more days late on multiple occasions.

So start to pay your bills on time. Learn how to increase credit score to 800. Even if you don’t quite hit that number, you’ll be far better off.

Go back to the debts that are in collections and start to negotiate.

These so-called bad debts often get sold to collection companies for pennies on the dollar.

Thus while I always think paying what you owe is important to your integrity, if you are dealing with a collection company and not who you borrowed from originally, don’t be afraid to make a low-ball offer.

If they can get 25 cents on the dollar of what you originally owed, they will likely take it!

You have the right to sue debt collectors that violate consumer protection laws. Call us today to learn more. We can stop the harassment. pic.twitter.com/PhJL1MaWtw

— ConsumerLawCRP (@ConsumerLawCRP) July 2, 2020

Does paying off collections improve credit score?

The short answer is yes, but you have to handle it the right way.

When you have debt in collections, that means that someone other than who you originally borrowed the money now owns your debt.

Usually, these are companies that specialize in buying debt for pennies on the dollar.

In other words, if you originally owed $1,200 to a hospital, but never paid, eventually they will likely sell that so-called “bad” debt to a collection agency.

Most likely they would sell that $1,200 debt for $400 or less. So if the collection agency can badger you into paying even half of what you originally owed ($600), they make a profit.

What they don’t care about, however, is you or your credit score.

If you just send them a check, or (worse) give them your bank account and routing numbers, they will take the full amount you originally owed, often with late fees, penalties, and interest tacked on.

And while they will likely mark the debt as paid, they will do nothing about the collection notices on your credit report that are keeping your score down.

So, it’s imperative that you not give them a cent until they agree in writing to remove all entries to this debt on your credit report with all credit reporting agencies (Equifax, TransUnion, and Experian are the 3 big ones) within 30 days of getting your payment.

Then, and only then, mail them a money order or cashier’s check in the agreed-upon amount (which can and should be a lot lower than the amount you originally owed).

They may say all kinds of things during the negotiation phase (including claims of not being able to do that).

But the reality is they can change their entries on your credit report and since all they really want is to get money from you, they will be willing to do it as long as you don’t cave and pay them before you get their written agreement (email is fine).

End your cycle of always being behind on your bills!

Are you struggling each month to pay bills? Maybe you’re behind on bills or have more bills than you do income. You’re left wondering where your money went each month instead of telling your dollars where to go?

I get it! While you can learn how to increase credit score to 800, ultimately you need to get out of the rut and make different financial decisions.

To get ahead, we need to do a written budget every month before the month begins.

You’ll almost never get ahead by just winging it, so get intentional with your money and show it who’s boss!

Want the best budgeting tool out there? Download my FREE Excel household budget template now!

Once you get it, you can dive deep into how to use it and why it works in another post about why this is the Best Excel Household Budget Template (click to read on my site).

So, to sum up, here are my . . .

5 Proven Tips on How to Increase Credit Score to 800

-

Pay down your credit card debt as much as possible

Pay at least to where you owe less than 75% of your total credit limit. Have 4 cards each with $4,000 limits? Pay each one down to where you owe less than $3,000.

-

Borrow from friends or family if you have to

If you can’t pay down your debts, don’t borrow money from any source that will impact your credit report; friends or family are the best options.

Sign an agreement if needed, but they won’t be running your credit or reporting the loan.

-

Deal with debt collectors

If you have any past due bills or debts in collection, pay them off (negotiating down and having them remove their fees).

But get it in writing (email is OK) they will remove any entries from all credit report bureaus within 48 hours of receiving your payment.

Always get agreements in writing before you pay and only pay by cashier’s check or money order when paying debt collectors.

-

Don’t take out any new loans, credit cards, etc.

-

Avoid giving out your social security number

Don’t inquire about any purchases or loans where you have to enter your social security number. Any time you give your social, you risk having them run your credit. Each time your credit is run, it can knock down your score temporarily.

They also give you instant access to your credit report for all 3 bureaus, daily monitoring of your credit, including info of yours that could be on the dark web and $1,000,000 in ID theft insurance!

Rather just pay a reputable company to fix your credit for you?

I get it! You just want to live your life, enjoy your family and friends, and build a future. And you don’t want to be dragged down or held back by credit problems.

Luckily, The Credit Pros use the power of AI to manage your credit for you quickly and easily!

And unlike a lot of credit repair companies that are spammy and scammy, The Credit Pros have actually been featured in places like:

- Forbes

- ConsumerAffairs

- Investopedia

You get easy to read credit reports and personalized score insights. Credit monitoring is included also, and the tools and info you need to quickly, easily, and legally improve your credit score.

Schedule a free consultation, or just get started over at The Credit Pros and get started today (just click the link to see all the details on their site).

Final thoughts

In this post, we reviewed how to increase a credit score to 800 and the top things you can do to quickly raise your credit score.

We also looked at how the scores get calculated, what areas impact the score the most. And we also looked at some of the myths out there about boosting credit scores quickly.

We also reviewed some of the best tips for not hampering your credit score right before a big purchase. Most importantly we now understand what’s possible and that it’s entirely possible to increase a credit score to 800 without having to pay a company to do it for you.

What’s your credit score?

In over your head? Find Your Best Personal Loan Option can help!

If you’re in the situation where you think a personal loan might make sense to consolidate credit cards, pay off student loans, or take care of some much-needed home repairs, the folks over at HonestLoans make it easy to get the best offers in under 2 minutes.

Even as little as a hundred bucks.

You could possibly save thousands a year and you have nothing to lose in checking! It doesn’t even ding your credit score to look at the offers!

CLICK HERE to see how much you can borrow! Apply in seconds and often, you can get the funds in your bank within 24 hours.

If you like this post, please follow my Credit Score Tips board on Pinterest for more great tips from myself and top credit score experts!

While I have years of successful financial & budgeting experience and run several million dollar businesses and handled the accounting, P&L and been responsible for the financial assets of them, I am not an accountant or CPA. Like all my posts, my posts are opinions based on experience, observations, research, and mistakes. While I believe all my personal finance posts to be thorough, accurate and well-researched, if you need financial advice, you should seek out a qualified professional in your area.

Photos (that aren’t mine or which require attribution):

Credit Report – Before and After by TrinityCreditServices is licensed under CC2.0

What about bankruptcy that was charged off but still on credit score

Well I’m not a bankruptcy attorney, but generally bankruptcy will stay on your credit report at least 7 years or maybe longer depending on which type you file. If it’s definitely been on your report longer than expected, I would file a dispute with the 3 main credit bureaus (Equifax, Experian, and TransUnion) and request it’s removal. You’ll need to submit the court documents showing the date the bankruptcy was finalized in order to do that.

Good luck!

Jeff