Traditionally, my family would use credit cards every holiday season for gifts, food, and travel, and then come January, we’d be deep in debt. We ended up figuring out a better way, so here’s how to save money for the holidays.

To save money for the holidays without debt, start saving in January. Tally the total expected expenses including travel, gifts, and food, and divide that by 11. Save that amount each month from January through November.

The good news is that with just a few minor tweaks in your planning throughout the year, you can have the Christmas of your dreams without the dread of huge credit card bills hitting in January.

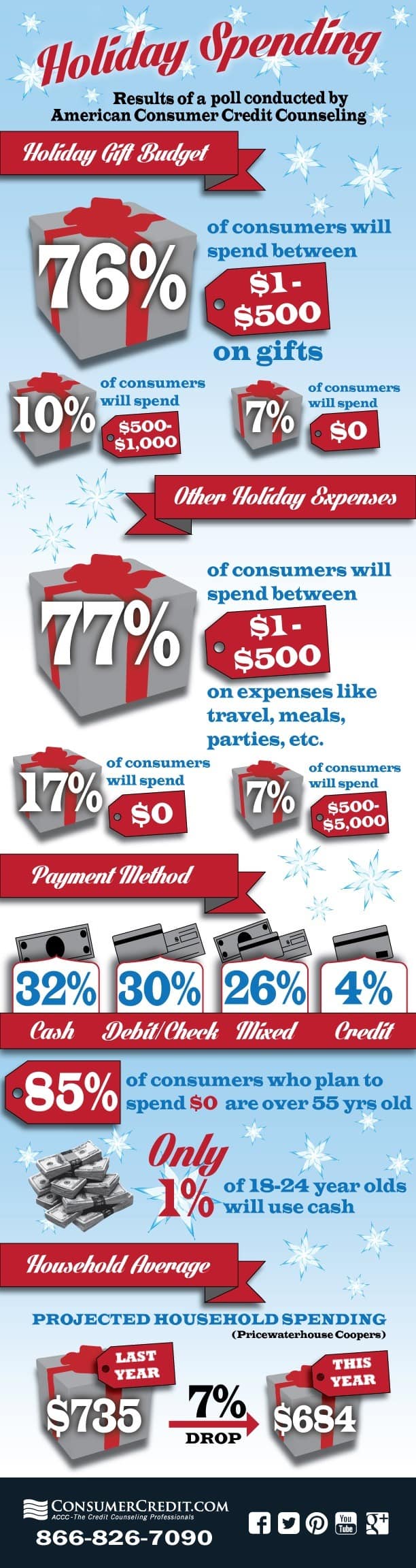

In this post, we’re looking at all the top Christmas and holiday spending statistics.

We’ll discuss how much you should spend on your kid’s presents. And we’ll also talk about some of the easy-to-forget expenses that can creep upon us.

And we’ll talk about the best strategies on saving money on the purchases you know you’ll make.

Specifically, though, we’re looking at the best tips on how to save money for the holidays without going into debt, so you can truly enjoy the holiday season.

Don’t celebrate Christmas?

If your family does ANY holiday gift-giving or party throwing in December these saving money for Christmas strategies can still apply and will help your family.

So here are my 29 best ways to . . .

Save Money for the Holidays

1. Set a holiday budget in January (that you and your spouse agree on)

- Agree (with your spouse) in January on an amount to spend for that year’s Christmas

- Stick to that amount!

- Setting the budget is the 1st step in saving money for Christmas the right way

2. Be realistic about your budget

- Be realistic about the amount you spend; a family making $40,000/year does not have to spend $2,000 to make Christmas special

- If you make under $100,000 gross household income but over $60,000, somewhere around $800 to $1,200 is about right.

- Make $40,000-$50,000? Somewhere around $600 is about right

- But if your gross household income is under $40,000 then spend accordingly, but it also doesn’t hurt to put some thought into both long-term career options as well as possibly picking up a part-time seasonal job

3. Don’t forget about additional expenses

- Are you doing any holiday traveling? That takes gas, minimally. But you may also have hotel and other travel expenses

- Are you preparing any large, lavish meals for additional family members? Remember to add that extra grocery expense to your budget

- Are you doing any holiday charity donations? Each year, we sponsor a foster child’s Santa list for about $100. Make sure to budget for that too.

4. Divide your budget amount by 11

- Divide the total you want to spend by 11 (months) to figure out how much you need to save each month through November

- Make sure you are doing a written household budget every month before the month begins and that you budget in your Christmas spending money so you aren’t scrambling each month to come up with it!

5. Transfer your monthly Christmas spending amount to a special savings account

- Automatically transfer that amount of money every month into a separate account that you only use to save for the holidays

- If you just leave it in your checking account it’s almost guaranteed you will find a way to spend it!

6. Set it and forget it so it’s out of mind

- The best part about a Christmas club savings account is that you don’t have to think about it!

- The money goes out of your checking each month into your Christmas club savings account

- Then it automatically transfers back into your checking at a set time (often Nov 1st)

- It makes saving money for Christmas easy!

- But it also removes the need for rigid discipline too

7. Book holiday travel plans at least 8 weeks out

- If you are traveling for the holidays, you can generally find the best deals on hotels & rental cars when you book at least 8 weeks out.

- Check out all the best deals available on my page of Ultimate Travel Resources to save you money

8. Check to see if you can housesit at your destination and skip the hotel expense!

- Housecarers is a worldwide company that matches people looking for a housesitter with people just like you!

- Travel Rent-free As A House Sitter Anywhere In The World

- Housecarers Has Been Securely Matching Homeowners With Housesitters Since October 2000

9. Tips if your budget is small

- Understand that saving money for Christmas doesn’t mean spending like you’re in Congress

- There was one Christmas where I was almost totally broke. You know what I did? I bought a case of mason jars, got out my pots and pans and made homemade salsa & pasta sauce and canned them up.

- Add a cool little label I made on my computer and printed on stickers and wa-la! Instant inexpensive Christmas gifts!

- You know what those gifts had that no store-bought gifts could ever have? My love, care and personality and, literally, my flavor.

- Family and friends mostly just want you and to connect with you, so don’t stress over budgets; just put down your phone and spend some time connecting and being present to your loved ones. Trust me; that’s the greatest gift you can give them!

10. Crucial tips to not go into debt

- Agree to not use credit cards or other debt to cover Christmas expenses

- See my example above about how simply not charging your Christmas spending to credit cards could help put an extra $3k in your pocket!

- Understand that the money set aside should cover all holiday expenses including travel, food, and gifts for spouses

- Trust me, even if you were diligently saving money for Christmas spending all year, it’s easy to spend all that on presents, forgetting about other expenses

- Recognize that many of us splurge on Christmas dinner, travel, nice bottles of wine, etc. That money needs to come out of your Christmas fund too

- Don’t painstakingly plan all year and then blow it on the finish line – this planning is designed to make your holidays loving and stress-free

11. If you can’t find room in your monthly budget, find expenses to trim

- If you cut $20/month on groceries, that’s only $5.00/week; ANYONE can afford that

- Then consider getting rid of expensive cable TV and get the top-rated digital antenna from Amazon for under 30 bucks, or get a Roku stick (click for current Amazon price) and stream Amazon Prime, Netflix, Hulu, and other similar channels. Don’t have Amazon Prime? It’s got tons of channels, movies, and TV shows.

- Try Amazon Prime free for 30 days! You’ll also get their famous free 2-day shipping on all qualified purchases.

- Cut back $10/month on entertainment & clothing expenses and with everything combined you can easily set aside at least $50/month in your Christmas budget

12. Use Black Friday & Cyber Monday to your advantage

- Department stores and online retailers are counting on your buying extra things when you shop on Black Friday and Cyber Monday

- Those “unintended purchases” are where they make their money, but it can blow your saving money for Christmas strategy!

- Make a list of all the presents you intend to purchase and stick to the list!

- That being said, these dates can be a great way to get great deals on what you were going to buy anyway

13. Buy presents throughout the year to save big!

- Online and offline department stores don’t always have all the same stuff all year long

- Guess what they are trying to get rid of in spring? Winter clothes! And they’re getting rid of bathing suits in the fall

- Time it right and you can do your holiday shopping throughout the year and save a huge amount of money

- To do it right, you’ll need to use your holiday savings knowing that come Nov 1st you’ll have less $$

- You’ll also need a good hiding place in your house to store them

14. Have a holiday shopping list of exactly what you want to buy

Just like when you go to the grocery store when you’re hungry and don’t have a list, if you just go Black Friday shopping or surf Amazon with a glass of wine and no plan, you WILL buy things you hadn’t planned on buying. Impulse purchases will blow your budget faster than Congress!

So make a gift list of everyone you want to buy presents for.

You should already know what you want to spend, so give each person on your list an amount. Then decide what to get and make sure it’s within that dollar amount.

Then start shopping knowing exactly what to get.

15. Group purchases to get free shipping

I was just on a website to get one of my kids a present. But while I was there, I saw things I knew my other 2 daughters would like. And guess what? Getting 3 presents put the total over what that website required to get free shipping.

If I had just bought the one present and then later bought gifts for the others, I might well have paid a lot of shipping costs.

16. Consider a white elephant gift exchange with friends, co-workers, and extended family

A white elephant is where everyone agrees to a set (and small) budget per present to get each other. And the fun is that you never know who’s going to end up with what gift.

But if you spend $20-50 bucks on every person you might need to give a gift to you could wind up spending a lot of money. This is really smart if you have a lot of people outside your immediate family and friends to get gifts for.

So consider a white elephant exchange for all but your closest friends and family with a budget of $5-10 bucks per gift.

17. Store wrapping paper securely to reuse next year

Many of us buy a boatload of wrapping paper and feverously wrap gifts at night while the kids are asleep. Then we shove those rolls in a closet.

Then we either forget we have it next year and buy more. Or we find it’s all torn, bent, or worn.

So instead, get a gift wrap organizer like this one on Amazon. It keeps everything neat, tidy, organized and will slide under a bed or stand upright in a closet.

And next season it will be in perfect shape.

18. Plan your lavish holiday meals in advance

Meals during the holiday season tend to be larger and more extravagant than meals we have throughout the rest of the year.

As such, it pays to plan them at least a few days, if not a week or more, in advance.

Then when you’re at the grocery store doing regular shopping, look for coupons and sales on things you know you’ll need for your holiday meals. As long as they aren’t going to go bad before the event, you can save a lot.

Plus you’ll spread out the grocery shopping expense rating than doing it all on one day.

19. Make sure you have an emergency fund

An emergency fund won’t help you save money during the holidays.

But, if anything happens out of the ordinary during the holidays (burst pipe, car accident, broken heater, etc), an emergency fund will ensure you don’t have the added stress of trying to pay for that on top of all the other expenses during the holiday shopping season.

20. Agree to limits on a secret Santa exchange

Many times office co-workers will do a secret Santa exchange. Now if you can talk your boss into a white elephant exchange, even better.

But if not, consider setting a (low) spending limit with your co-workers.

There’s nothing worse than getting someone a $15 gift and then getting a $30 gift in return. Plus it will also ensure that you don’t go crazy buying gifts for everyone.

21. Take a look at where your credit cards get you the most points

Now, many of you may well not want to use credit cards at all; after all that ENSURES you don’t go into debt. But if you have some discipline and use a budget and pay off your credit cards each month, why not take advantage of the points?

Different cards give extra points in certain categories and at different merchants.

Make sure you know what those things are so you can maximize your points. Then use those credit card points to treat yourself later, or convert them into payments on your balance.

It’s not a paid endorsement, but I’ve learned a lot from The Points Guy.

22. What if one gift you want exceeds your budget?

Being smart with money doesn’t mean you can’t ever break your own rules.

What it means is that you are intentional with your money and you make informed decisions based on information rather than emotions.

So if there’s a really meaningful gift you want to buy for that special someone, it’s OK to do that, even if it technically exceeds your budget.

Just know how much over big-ticket items will put you and have a plan to pay that off as quickly as possible.

23. Hit the Dollar store for small gifts and holiday party gifts

Dollar Tree, Dollar General, and The Dollar Store can admittedly be a little hit or miss. And they can be a bit disorganized.

But if you’re patient and strategic, they are a great place to shop for gifts you might bring to a friend’s holiday party or for stocking stuffers.

24. Get your budget back on track in January

With all the lavish spending and holiday cheer in November and December, it can be easy to just keep rolling that way in January.

So it’s a really good idea to go back to your pre-holiday budget the moment the new year hits.

Curb eating out, cut back on groceries, and hold off on gifts for a bit until things settle out. Especially if you use credit cards, it might be well into January before you really know where you stand financially.

25. Remember online shopping will save time and gas

It’s great to support local, small businesses. But let’s face it. Sometimes we spend hours, or all day shopping in a dozen stores driving all over town, and still don’t end up with what we want.

So depending on the gift, consider letting Jeff Bezos do the heavy lifting and save yourself the time, headache, and gas.

26. Skip the Christmas cards

I always admire my family members who diligently mail out Christmas cards every year.

But between the cards, the stamps, and trips to the post office, it’s a lot of work for something that will get looked at for about 10 seconds and then stuck on a shelf or mantle and then tossed 6 weeks later.

27. Don’t forget to start your holiday budget in January

January might seem like a weird time to think about the next holiday season. But that is EXACTLY when you need to start planning and saving for it.

I go into greater detail on that below.

28. If you still end up with a mountain of holiday debt

Even with great intentions, if we aren’t on the same page with our spouse, or we don’t have the right systems in place, it’s easy to end up with a lot of holiday debt come January.

If you are in that boat, don’t hide your head in the sand.

Instead, see how much it is and come up with a plan to pay that off as fast as possible. If you have an emergency fund, use that to pay off the debt. But DO start saving in January for the next holiday season so you don’t repeat the cycle.

Without an emergency fund, just cut back on other spending and pay as much on the debt as possible.

29. Look at what you actually spent and see if your budget needs to be adjusted for next year

Once January rolls around look at what you actually spent. Was it within the budget? Under budget, a little over, or way over? If it was way over, was everything spent truly needed? If yes, adjust what you start saving in January for the next season so you end up with the right amount.

Frequently Asked Questions

What is the average Christmas budget?

According to Gallup, one of the long-standing premier polling companies in the US, the “average” American family will spend $785 on Christmas this year.

This is consistent with previous years, but down quite a bit from the all-time high of $909 in 2007.

You can see more statistics on Christmas spending on their chart, which shows that while the average will spend $785 this year, the majority of families actually spend $1000 or more.

What is a Christmas account?

I go deeper into why you not only need a Christmas club savings account but also 4 other bank accounts in a previous post about why you need Multiple Bank Accounts for Budgeting (click to read on my site) and not just checking and savings.

If you’re going to do Christmas saving right, it’s essential you check out that post for more detail.

A Christmas club savings account sometimes called a Christmas Club, is simply a bank account that is specific for saving money for Christmas.

This program came into effect during the great depression.

Essentially you set money aside every month (or week) into this special savings account. Then in November as it approaches the holiday season, the bank automatically transfers it back into your checking account.

Trust me, it makes learning how to save money for the holidays easy!

Do you have your shopping done? Get a head start on your shopping next year by opening a Christmas Club today! You can open an account with as little as $1.00. pic.twitter.com/pkrH849FSE

— KingstonNationalBank (@kingston_bank) December 13, 2018

Do banks still have Christmas Clubs?

The short answer is yes; many still offer a Christmas club savings account for saving money for Christmas. My credit union does and that’s what my family uses.

But according to the Credit Union National Association (CUNA), only 9% of people in America use a Christmas club savings account.

They go on to say that about 72% of credit unions still offer them. While some banks also offer them, the credit union is the king of the Christmas club savings account.

So if your bank doesn’t offer one, take a look at your local credit unions. They likely offer that, along with the personal service that can come with not being a huge multi-national industry.

How can I save money for Christmas all year?

One of the keys to learning how to save money for the holidays, no matter how much you spend, is to start saving for it months in advance; ideally in January.

According to the website Statistica, in a recent study, they found that upwards of 66% of people did not save anything for Christmas spending.

In looking specifically at European countries, The Czech Republic dominated, followed closely by the United Kingdom. But even then, the highest percentage that did Christmas saving was only 35%!

So if you’re in that boat, don’t feel bad; you’re in good company! But I do want to make some suggestions that will set your family up for future financial success!

#ad Shopping for holiday gifts can add up quickly but it’s important not to overspend. That’s why I’m sharing my tips to help stay on budget during the holiday season, like shopping with ibotta. Check out all my tips here ➡️ https://t.co/vPmtF5eI01 #IbottaPartner pic.twitter.com/zVxhrZASK8

— Lori Felix (@morewless) November 25, 2019

How can I stay on budget during the holidays?

Every November and December we begin to face some tough choices.

We get party invitations or invited to travel for the holidays. We also can be expected to invest in gift exchanges at work or with family.

Sometimes we’ve known about these things well in advance.

But often, they come out of the blue and sneak upon us. When that happens, we have a tough choice to make. The choice is rooted in the fact that if we’re committed to not going into debt. When we start to learn how to save money for the holidays, we start planning for that spending in January.

So by November, we’ve already saved and earmarked all our holiday spending money.

If we have every penny allocated, then unexpected expenses just don’t have a place in budget. Ultimately the best strategy when you’re figuring out how much money to save for Christmas would be to pad it for unexpected expenses.

But if you haven’t done that you’ll have to get used to saying no to things that are less important.

Think about it this way. Every time you say yes to one thing, since our resources are finite, you are saying no to something else. So make sure everything you say yes to is at the top of your priority list.

You may disappoint friends, co-workers, or family, but you’ll feel a whole lot better in January when you don’t have any new credit card bills!

What is a reasonable Christmas budget?

The key to anything is simply planning ahead, being consistent, and being intentional with your decisions. For learning how to save money for the holidays, the good news is that the holidays are consistent.

It happens at the same time every year, and for the most part, our families all do the same kinds of things and spend money in the same kinds of ways.

This is what my family does to prepare for Christmas spending:

- We plan to spend $1,000 on Christmas spending

- We know the majority of that will be spent starting in late November

- Thus we divide $1,000 by 11 (months) – that equals $90.90

- We set aside $90.90 each month (starting in January and transfer from our checking into our Christmas club savings account (that is one of the 5 bank accounts we have)

- That $1,000 includes what we spend on a foster child whose Santa list we sponsor each year (roughly $100)

- That $1,000 also needs to cover extraordinary expenses (such as travel or fancy Christmas grocery items)

The amount your family spends may vary and that’s OK! You don’t need to spend a fortune, go into debt, or wreck your family’s finances to make your kids happy.

In fact, just the opposite.

When your kids see you saving and spending wisely (and if they still believe in Santa as my youngest still does, this lesson will come later) you are setting them up for future financial success and ensuring they will win with money!

Christmas is almost here, let the spending begin! 🔔

Black Friday, cyber Monday, Christmas sales, gifts for friends and family, hangouts, parties, etc.

How do you consistently save money even during this period? Tap the link for my top 6 saving hackshttps://t.co/q93J3NPNbw pic.twitter.com/EbdFp59swS

— YT: The Antwiwaa (@the_antwiwaa) September 8, 2021

How much money should I save for Christmas?

Dave Ramsey, the top money expert in America, was asked how much he recommends saving money for Christmas.

Dave came back with the following:

- The average Christmas spending per family last year was around $800

- The average household income was around $50,000.

- If you make $25,000, then you would be half of average, and your whole Christmas budget should be about half of the average, or about $400.

- If you make $200,000, you could go as high as four times that ($3,200) if you wanted to and still be “reasonable.”

He goes on to say “I’m always of the opinion the adults can fend for themselves. In case of a budget crisis, we should only take care of the children.” I would agree with all of his opinions, wholeheartedly, but then I am a big Dave Ramsey fan!

Dave Ramsey says: Christmas doesn’t require spending a lot of money https://t.co/fq3OZyz4JM pic.twitter.com/kELgoHXfxg

— Deseret News (@DeseretNews) December 9, 2014

One thing that’s important to remember is that it’s not the amount of money you spend on Christmas that makes it special.

Now if you’ve spoiled your kids the last few years to the degree that they now behave like Dudley from the Harry Potter series, you’re going to need more than this blog to turn it around.

But I am convinced that any parenting oversights (and we all make them) can be fixed.

Simply being aware of the issues and being intentional and honest about them (with yourselves and your kids) is half the battle.

Need to recover from holiday over-spending? Try switching to a cash-only system for one month! Leave debit cards, credit cards and checkbooks at home. You won’t be able to spend what you don’t have. #savemoney pic.twitter.com/ATR5QbJQHf

— Generations FCU (@generationsfcu) January 4, 2020

How many people use credit cards for holiday spending?

In a recent survey by a company called creditdonkey.com, they found that on average, about 37% of families use credit cards to pay for Christmas spending.

I don’t advocate the use of credit cards at all and don’t actually have any in our house.

But I get our way of doing things may not be your way. That’s OK! But I do want you to think about the choices you make regarding debt. I want you to be intentional instead of just reaching for them out of desperation.

Need to spend more than you have? Rather than go into debt, why not check out one of my most popular posts about 53 Ways to Earn Extra Money on the side? Just click that link to read it on my site.

Many don’t even require you to leave your house!

Why is going into debt for Christmas spending bad?

Let’s look at how debt robs you of your Christmas cheer!

Statistics courtesy of ValuePenguin. Credit Card interest figures courtesy of Bankrate.com’s calculator.

- The average credit card interest rate is currently about 16% (according to CreditCards.com)

- Let’s assume that your family only charges $800 for Christmas spending to that credit card

- Over 38% of households use credit cards already

- The average household carries upwards of $6,000 in credit card debt already (and that figure, on average, is much higher if you live on the east or west coasts in the US)

- So if you charge an additional $800 on top of the likely $6,000 you already have, your average minimum monthly payment could be as high as $442.

- Paying only minimum payments, it will take about 81 months to pay off the total debt (and that, of course, is ONLY if you quit charging new purchases)

- 81 months is almost 7 years!

- In that 7 years, you will not only repay the original $6,800 you borrowed but an additional $1,724 in interest!

- Putting aside the amount you charged, just investing that $1,724 instead of paying it for the privilege of borrowing money could earn you upwards of $3,359! (factored using an average of 10% growth over 7 years – compound interest calculator courtesy of moneychimp.com). You would almost double your money!

Of course, interest rates vary and are not guaranteed, so your actual results could be different – my point is to get you to realize just how bad an idea it is to use credit cards and what taking the same money and using it in a different way could do for you and your family!

Imagine what you could do with an extra $3,359!

How do I save money on a tight budget?

The key here is budgeting. A written budget you write out and stick to before the month begins. You want to know exactly where all of your hard-earned dollars are going, even if you don’t have a lot of them.

Once you begin to use a budget you’ll quickly identify if you have a spending problem, an income problem or are simply living beyond your means.

If you still struggle with trying to budget money on a low income (click to read on my site), check out one of my most popular personal finance posts to give you more actionable tips to get back on track!

Not on a written monthly household budget?

It’s essential for the financial future of your family and essential for learning how to save money for the holidays. I have a copy of my Budgeting Spreadsheet available at no charge.

It’s a simple, highly customizable, Excel spreadsheet and you can download it quickly and easily FOR FREE!

Final thoughts

In this post, we took an in-depth look into the world of Christmas and other holiday spending.

We looked at averages and statistics and the most common spending patterns and habits of families. We not only talked about ways to save for Christmas so you don’t go into debt, but we also talked about strategies for saving on the things you buy.

Specifically, though, we looked at how to save money for the holidays so you aren’t stressed over bills or debt and you can actually enjoy the holiday season.

With just a little bit of planning, you can nail this holiday season and all to come! How does your family do holiday spending?

If you like this post, please follow my Budgeting board on Pinterest for more great tips from myself and top parenting experts!

As an Amazon Associate I may earn a small commission from qualifying purchases if you click to Amazon from my site and choose to make a purchase. You can read my complete affiliate disclosure for more details.