Investing. Whether for retirement or building a nest egg, it scares most people. Learning to invest in mutual funds just requires learning a few basic terms, signing up for an online broker program, and starting with as little as $100.

Everyone knows they should be investing for their retirement or to generate extra income. But many fail to get started because of 2 things:

- Fear

- Lack of knowledge

Thankfully a lot of employers these days offer a 401k plan which almost forces the workers to invest in their future.

Sadly though, according to The Pew Charitable Trusts, only about half of employees are utilizing a 401k. Those who do invest only invest the bare minimum; a far cry from what many will need to retire.

But fear not!

Investing doesn’t have to be scary or intimidating.

You can set aside enough money each month to retire in style and dignity and maybe even become a millionaire in the process!

So today, we’re taking the mystery out of investing and breaking it down step by step.

We’ll answer all the top questions and look at the best ways to invest. Specifically, we’re looking at the best and simplest process of learning to invest in mutual funds so your “golden years” will truly be a dream instead of a nightmare.

So why is investing scary?

For starters, most of us aren’t taught ANYTHING in school about the stock market, investing or retirement. Learning to invest in mutual funds isn’t ever shown to us.

Our parents or grandparents maybe had pension plans but not a lot of knowledge either.

We also see people who are investors or people who work on Wall Street portrayed rather poorly in the media. Thus it’s simply not something most of us know about or aspire to learn about.

Tony Robbins: Think of Investing as Your Second Job @tonyrobbins https://t.co/C8kZEPeAPZ

— Inc. (@Inc) April 29, 2016

How do we get past fear?

So we know that like anything else, we are scared of the unknown.

Think back to when you first started learning to drive a car. For me, that was a hardship license at 15.

Driving was SCARY! Knowing the brake pedal was on the left and the accelerator on the right wasn’t intuitive yet. Knowing how much to step on a pedal to get the desired result was also foreign.

How did driving become not scary? By learning how to do it and practicing repeatedly.

Learning to invest in mutual funds is NO DIFFERENT from learning any other task

It may seem scary now, and you may never become a CPA (Certified Public Accountant), but you can move past the fear of learning to invest in mutual funds. You just need to become familiar with the terms and processes.

Then you simply need to START. Thus my #1 investing tip for beginners is just to get started! Quit waiting or procrastinating.

It’s not an investment or retirement book at all, but if you struggle with fear the book START is an awesome book designed to help you escape average, punch fear in the face and learn to live a life that matters!

It has almost 5 stars, hundreds of reviews, and is from Wall Street Journal best-selling author Jon Acuff.

Many of us freeze in the face of the unknown or the uncomfortable. Want to be great at something? Do you wish to truly be an inspiration? Then you have to move past fear.

You have to START.

Investing for retirement

I wrote an earlier blog post about the Best Ways to Save for Retirement.

That post covers the reasons you need to be investing for retirement. It also goes in-depth in covering the terminology and different options.

Thus if you are learning to invest in mutual funds and don’t know what I mean saying “mutual fund” or “compound interest”, I highly recommend you take a look at that first post and then dive back in here.

The #1 stock tips for beginners

Personally, I don’t recommend buying large numbers of stocks.

Think of it this way. You are putting all your financial eggs in one basket. If that company does great, you could earn a lot of money. But what if you had invested in K-Mart, or Radio Shack, or Sears? If you had, you could have lost a lot of money.

Unless you are really in tune with a particular retailer’s daily, weekly, and monthly ups and downs it may not be a good idea to invest in stocks. You also have to be in a position to monitor the stock market often so you can respond quickly.

Are there a lot of people who have made a lot of money investing in stocks?

Yes, there undoubtedly are.

That’s just not the strategy I use or recommend, especially for beginners. So since you’re here learning to invest in mutual funds, I suggest skipping stocks altogether.

Are mutual funds safe?

Mutual funds are simply a group of different stocks all managed by a group.

The best part about mutual funds is since you’re investing in several companies instead of one, you minimize the risk. In other words, company stock sometimes goes up and sometimes goes down. When it goes up you make money and when it goes down you lose.

When you invest in mutual funds instead of a single company’s stock, you know that even if 1 company’s stock within that fund goes down, you still have all the others!

Thus the fund gives you a cushion and it spreads the risk out across a number of different companies.

So yes, compared to almost every other kind of stock market investment, mutual funds are very safe, especially if you’re smart in picking them.

But, of course, like ANY investment, there is always going to be a risk as the stock market has always gone up (where you can make money) and down (where you can lose money).

The importance of minimizing risk

Minimizing risk is good!

After all, this is your hard-earned money we’re talking about and we want to make it grow for your retirement! So that’s why my #1 investing tip for beginners, after starting, is to go with mutual funds.

Investing in a mutual fund allows you to minimize risk and maximize returns. #investing #funds #finance #riskmanagement #assetmanagement pic.twitter.com/9QntFKXCFz

— FCSL Group (@FCSLNG) December 8, 2016

Picky about what types of companies you invest in?

Most mutual funds are categories of funds.

Some feature things like renewable energy while others might favor biotechnology. Thus you can tailor your investments to meet your personal beliefs.

How much money should I invest in mutual funds?

Investing is just a good habit to get started.

The #1 learning to invest in mutual funds tip with little money is to just start even with just a few bucks.

The younger you start the longer your investments have to grow. You also will learn better and better habits and strategies the more you do it. But when we are in our early 20’s chances are we don’t have a ton of money to get started with.

That’s OK! Starting small is WAY better than not starting at all. It’s also way better than procrastinating and waiting until you’re older. As I mentioned above, some mutual funds do have minimum investments, but many do not.

You could literally start at less than $100.

I use Fidelity for my investing and they don’t have a minimum investment required to open an account. They do have trading fees which you can see here. I go into much more detail below.

But if you only have $100 bucks you can get started today!

What is a 401 K retirement plan?

The 401k is a retirement plan possibly offered by your employer.

Often (but not always) they match a certain amount of money you put in. Then you invest both your money and the company match in a variety of what are called mutual funds.

Usually, in the 401k, your employer will simply take out a certain dollar amount or percentage each paycheck and invest for you. But while they will limit your mutual fund choices within their plan, you can often go through the list and choose for yourself which mutual funds you want.

I go into much great detail on how to evaluate mutual funds below. So fear not, you’ll be learning to invest in mutual funds in no time!

The other good news is, whether, in a 401k or your own Roth IRA, you get to decide how much you put in.

As a general rule, if you want to live well in retirement, you should be investing about 15% of your gross income. So aside from just starting, investing 15% of your income is one of my next best learning to invest in mutual funds tips.

Can’t make 15% work? Anything is better than nothing.

But the longer you wait to get to 15% the harder it will be to live well in retirement.

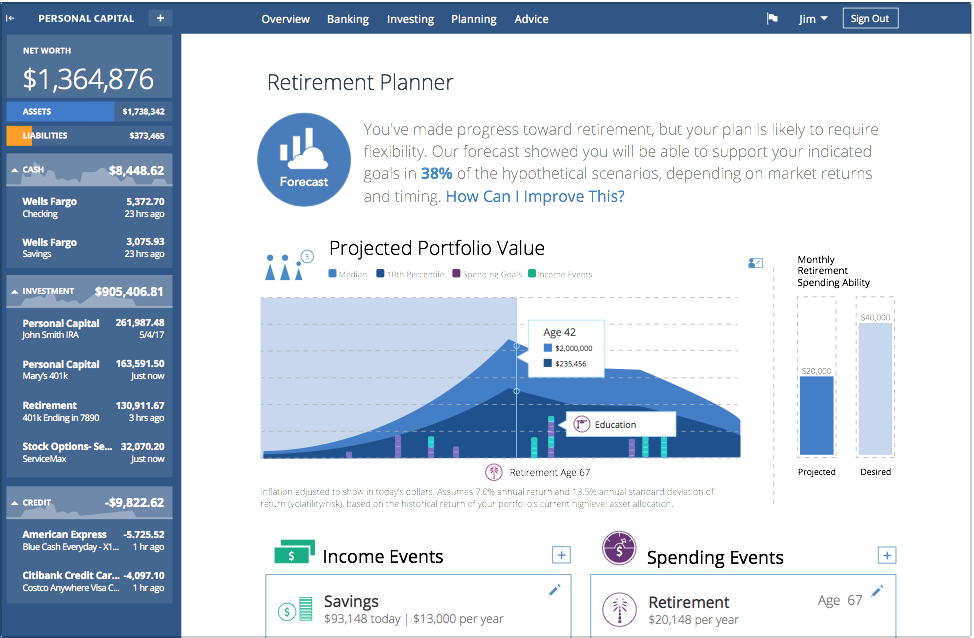

Now you can take advantage of the most sophisticated, realistic retirement planning calculator available today – so you can prepare for the retirement you want.

Check it out, FOR FREE, from Personal Capital!

The tax benefits of a 401k

One big plus with the 401k is they take that money out before your employer withholds income tax! That makes your “taxable income” smaller (meaning you owe the IRS less).

No; you only pay income tax on your 401k when you cash it out.

The exception here would be if your employer offers a Roth 401k which is a new trend and a great thing when learning to invest in mutual funds (more on the difference below).

Just make sure to never:

- Cash out a 401k before age 59 1/2 (IRS retirement age in most cases) – you’ll not only pay your tax rate, but also a 10% penalty!

- Borrow on a 401k – Yes, the interest you pay does return to your investment, but if you don’t repay on time, it can be considered a cash out. Plus if you’re trying to get ahead financially, you need to avoid additional debt!

- Forget about your 401k when you change employers – That money, including the company match, is yours! Don’t let it languish when you change employers. Simply do a direct transfer rollover to a traditional IRA (Individual Retirement Account). That way you keep control over your money.

Should I cash out my 401k?

No is the answer you’re looking for.

But if you’re deeply in debt, why wouldn’t cashing out your 401k be a good idea? Let’s examine why this seemingly tempting plan is actually terrible.

Many of you reading this likely fall into a 25% tax bracket. Thus when you cash out, you’ll have to not only pay 25% of the total to the government but also a 10% penalty.

Would you go borrow money at 35% interest to pay off debt that is likely at an interest rate of less than half of that??

No is the answer you were looking for!!

So it is never a good idea to cash out a retirement fund unless you:

- Are facing bankruptcy

- Are about to get foreclosed on and can’t work out a short sale

What if you need access to your money?

Borrowing on a 401k is far less of a dumb idea, and I’ve done it myself (I’ve done the cash out too, so I know just how dumb that was!)

After all, you just repay yourself and while they do charge you interest, you keep that too. My biggest issue is that it’s just another means of debt, but to many, it doesn’t feel like debt. It doesn’t feel like debt because you’re paying yourself.

Make no mistake though; debt is debt!

As I said above, if you don’t stick to their repayment schedule it could be perceived as a cash out by the IRS. Also if you change employers you then have a very small window to repay that loan.

If you don’t, you guessed it; it just became a 35% loan.

So it’s still not a great idea. So learning to invest in mutual funds also means learning what NOT to do.

What is the best thing to do with your 401k when you change jobs?

Changing employers is something that happens to many of us.

Many of you reading this likely have an old 401k you forgot about or aren’t sure what to do with. It’s not the end of the world if you forget about it and let it sit there.

However, you lose the ability to contribute to it or get the company match. You also can only invest that money in the group your old employer contracted with.

A direct transfer rollover is what you want to do.

You roll it into an IRA (traditional in most cases). That way you control the investments and you have an account with the investment company you are using. I mention the “traditional” IRA which is just like a 401k. You only pay tax on it when you cash it out.

The Roth IRA (or Roth 401k) allows you to put money in after you’ve paid tax but all the interest it grows is tax-free! A better option for sure for most of us.

However, doing a rollover from a 401k means you would have to pay tax when you do the rollover if you chose the Roth. Thus if you don’t have that extra cash laying around, you’ll want the traditional IRA.

Doing a 401k transfer right is one of the best learning to invest in mutual funds tips for those of you in this boat.

Confused about the difference between a Roth or Traditional IRA or 401k? Let Dave Ramsey explain it better!

How to roll over your 401k

When you do this rollover, making sure you get a “direct transfer” is crucial.

That way the money never hits your hands; it goes right from your old 401k into the new IRA.

If the old company cuts you a check, guess what the IRS calls that? You guessed it! That’s considered a cash out; hello 35% loan!

I personally use Fidelity for my investing, including my old 401k rollover. But you could also use Etrade, a local stockbroker or any of a number of other online companies.

But don’t get frozen in trying to decide which is better. That’s a good way to find yourself having done nothing 10 years later.

Avoiding analysis paralysis is also one of the most important learning to invest in mutual funds tips.

Why is investing for retirement important?

Let’s count the ways!

- Because you don’t want to have to work into your 70’s (hint: if you do, do it because you want to)

- Because relying on Social Security is risky! I’m not saying it’s on the verge of collapse or anything, but you don’t want all your eggs in one basket. Plus for most of you reading this, you will likely get $2,000/month or less to live on. I don’t know about you, but that’s not my retirement dream!

- Because you don’t want to be a financial burden on your kids or extended family!

- So you can enjoy life!

Millionaires don’t all drive sports cars and live on yachts every summer. They’re normal people who were SMART with their money.

Get @ChrisHogan360‘s #EverydayMillionaires book to learn just how normal they are: https://t.co/r8mt2kckkJ pic.twitter.com/cPzpkKEKcY

— Dave Ramsey (@DaveRamsey) January 18, 2019

Why a Roth IRA might be a better option

So if you don’t have a 401k at work (which is the case with me), you want a Roth IRA. As I said above, the Roth IRA simply allows you to put money in after you’ve paid tax but it grows tax-free.

Why is that important? Let’s do some math!

Say you’re 38 and you put in the maximum per year allowed by law ($5,500). If you invest that in mutual funds that, on average, earn 10% per year, guess what? Over 30 years, that grows to a whopping $995,188! (factored using the compound interest calculator from MoneyChimp)

If you pay 25% tax on that in a traditional IRA, you’d be handing over almost a quarter of a million dollars!

I don’t know about you, but I’d just as soon keep that money!

By the way, that $5,500 annual contribution is less than $500 a month. That’s right! For less than $500/month, you could retire with almost a million dollars! How’s that for learning to invest in mutual funds!

How do beginners invest in mutual funds?

So whether a 401k or a Roth IRA, your best bet for investing are mutual funds as I said above.

The good news with an IRA is that you can select any fund out there. With a 401k, you typically have to pick from a list your employer provides.

Either way, it’s time to do some investing research.

You want to look for funds that:

- Have been around 10 or more years (that means they are stable and not some fly by night company)

- In that 10 or more years you want them to have averaged at least 10% returns (meaning that there’s a very good chance your money will grow by 10% per year)

You also don’t want all your cash in just one mutual fund; arguably not much better than counting on social security!

So when learning to invest in mutual funds it’s important to have at least 4 different ones, so let’s learn more!

Categories of mutual funds

The best learning to invest in mutual funds tip would be to have your money in about 4 different funds. Different funds will be called different things, but the names are usually kind of explanatory.

You will see funds classified as:

- Growth – Means a moderate interest rate somewhere south of 10%

- Aggressive Growth – Better returns, but riskier; meaning returns can swing wildly from year to year

- International – Meaning that all the companies who have stock in this fund are not US based

- Conservative – More stable but with generally smaller returns of likely under 5%

If you go with a mix of these 4 you’ll get the best of all worlds; relatively stable investment options but with 10% or better annual returns (hopefully)

Classes of Mutual Funds

One other thing you’ll see with mutual funds are a “class” or type which relate to the fee or commission on the sale of the funds. You’ll see:

- Class A – Means you pay the broker a fee when you buy (what I prefer)

- Class B – Means you pay the fee when you sell the stock

- Class C – No commission fee, per se, but they may have other fees they ding you with

I prefer the A simply because once I’ve paid the fee, no matter what I do with the money or how much it grows to, it’s 100% mine.

One thing you can look at on the fund reports is what they call the expense ratio.

As the name implies, this refers to how much of the total you have to pay for expenses. Obviously the smaller the number the better. Ideally, look for expense ratios well under 1%.

Lastly, do be aware some funds have a minimum first investment.

That minimum investment could be $100 or $2,500 but whatever it is, the first time you buy it, you have to buy that amount. Future purchases, however, can usually be in any amount. So when learning to invest in mutual funds, just know that if you’re starting with a small amount of money, not all mutual funds will be available to you.

Thus, if you need to, save up for that initial purchase if it means getting a great fund with a long track record of over 10% returns!

So what are my . . .

13 Simple Learning to Invest in Mutual Funds Tips That Work?

1. START!

Any investing is better than none and even if you make a few poor choices, you’re still in the game. You’re still trying. You’re still doing something. Something is better than nothing!

2. EDUCATE YOURSELF

Chris Hogan, a retirement expert and formerly a part of Dave Ramsey‘s team, has an excellent book called Retire Inspired and also has an excellent podcast.

If knowledge is power then Chris is your man. Don’t have time to read? Do what I do! I have a 35-mile commute (each way) 5 or 6 days a week, so that’s plenty of time to listen to podcasts or audiobooks in the car.

3. SET YOUR SHORT AND LONG TERM GOALS

As with anything we undertake, it’s important that we understand the “why” behind what we are doing. Are you wanting to invest to save for retirement? Do you want to create a cash flow? Will you use the growth in 5 years for a home purchase?

There’s a lot of different reasons you may be learning to invest in mutual funds. Figure out what those are.

Once you know the “why”, then you move on to the “how”.

4. USE ONLINE TOOLS TO RESEARCH GOOD FUNDS

There are a million websites to research mutual funds: Morningstar, Money/US News just to name a few.

These sites list funds show performance history and the type of fund they are. You don’t need to be a CPA or CFO to understand the basics and even just a little familiarity with these sites will help you immensely.

5. OPEN AN ACCOUNT

The first step in starting will be to decide who to use for your investing.

Don’t worry; you can always change later if you wish to. Feeling really insecure about the process? In that case, I would use Yelp to locate an investment professional in your area.

Once you’ve found some with good reviews, just meet with them and see who you relate to the best. As Dave Ramsey says, “look for someone with the heart of a teacher”.

Speaking of Dave, you can also use his SmartVestor tool to find investing professionals in your area that he recommends.

6. SET UP AUTO DRAFTS

Whether a company 401k, your own Roth IRA or another investment vehicle, when learning to invest in mutual funds for retirement, its ideal to have minimum contributions automatically taken from your check or bank account each month.

I don’t know about you, but when I have extra $$ laying around, I tend to spend it. Having the money automatically deposited doesn’t rely on your willpower. It also gets you used to living on the amount left over.

The fancy term for having a set amount come out of your bank and into your investments each month is “dollar cost averaging”. But basically, you’re buying a set amount every month and every purchase may have a different value even though you’re spending the same amount of money.

For instance, let’s say you withdraw $100 each month into a mutual fund. The performance of that fund will likely be higher or lower in month 2, but you’re still buying $100 worth. Over time though, it should balance out to be a good investment. (if you’ve selected your fund well; but there are no guarantees)

7. UNDERSTAND YOUR RISK TOLERANCE

There is risk involved with learning to invest in mutual funds. Not Blackjack in Vegas risk, but a risk nonetheless. Thus one of the important investing tips for beginners is to identify how much risk you are willing to take.

Aggressive growth mutual funds might currently be trending at over 20% returns!

I have some in my portfolio like that. But guess what? Some months they are in the negative. I don’t watch my funds daily. I’m in this for the long term so I check my investments quarterly.

If you don’t have the stomach for the roller-coaster that can be Wall Street, you may want to invest in more conservative funds. They won’t likely have the huge highs, but they are also less apt to have the big lows too.

8. AVOID USING THE NEWS AS YOUR GUIDE

The news, whether print or TV, is designed to get viewers so it can raise it’s advertising costs. Thus, it makes sense that they tend to glorify catastrophe; it captivates their audience. I do want you to research funds and I do want you to stay up-to-date on what’s happening (but not constantly checking and sweating).

Just refer to the same websites you used for research and your investments and save the TV for your Walking Dead marathons.

9. DIVERSIFY

As I mentioned above, no matter what your risk tolerance, when learning to invest in mutual funds, it’s important to have your investments spread out over multiple funds or types of investments. Humpty Dumpty had all his eggs in one basket and look what happened to him.

When you spread your investments around different types as one goes down, you may see others go up. Thus you are (somewhat) protected from the volatility of the market.

10. KEEP YOUR EMOTIONS IN CHECK

As I mentioned above, it’s easy to want to check your investment performance often.

It’s also easy to want to jump ship every time a stock or fund plummets. On the flip-side when one goes up, many often think that’s a good time to buy more.

I want you to leave your emotions at the door. Wall Street is a roller-coaster and you should expect a crazy ride.

If you rashly or impulsively react at every little thing, you may find yourself selling low and buying high. Even the most inexperienced of people learning to invest in mutual funds know that’s not a good long-term strategy.

11. START OFF SMALL

You can always contribute more money.

But when you are learning to invest in mutual funds you naturally still have a lot to learn. You will make mistakes. Thus if your initial investments are small, you stand to lose less when those mistakes become obvious.

Your money, like your knowledge, will (hopefully) grow over time.

12. MAKE MINOR ADJUSTMENTS QUARTERLY

As we’ve discussed I don’t suggest making changes every time the market hits a speed bump.

What I do is to review all my investments once a quarter. I look at the trends in my mutual funds and I see how much they have gained or lost YTD (year to date).

I might make some changes based on that data, but in most cases I let it ride a little longer as for a fund that has a 10% average return over 10 or 15 years, a 3-month window is just a blip.

Learning to invest in mutual funds requires patience.

13. MAKE BIG ADJUSTMENTS ANNUALLY

When you’re on your 4th quarterly view, that is a better time to take action if you see a fund underperforming consistently. Sometimes funds are doing OK, but just not great in comparison to your other investments.

From one point of view, you might be tempted to dump the lower-performing one and put more into the top ones. However, doing that does reduce diversification. So be careful.

A better strategy might be to find another fund in that same category with a better 10+ year track record. Then you’d just sell the one and buy the other.

In many cases you’ll pay a transaction fee every time you do this, so that’s another important reason to not overdo it; all your profits can wind up going to the fees.

Did I cover everything you wanted to know about learning to invest in mutual funds?

Learning to invest in mutual funds doesn’t have to be scary.

You just need knowledge. But more importantly, you just need to start.

Starting and doing a mediocre job is still better than not getting started at all.

In this post, we took a very in-depth look into the world of investing. We looked at all the ways people invest; the good, the bad, and the ugly. We answered all the top questions and broke down the process step-by-step to take away the mystery that holds most people back.

Specifically, though, we explained the entire process of learning to invest in mutual funds so you can get started today for a brighter tomorrow.

If you like this post, please follow my Investing & Retirement board on Pinterest for more great tips from myself and top financial experts!

Photo credits (that aren’t mine) and are licensed under CC2.0:

Hands of growth – https://www.flickr.com/photos/68751915@N05/

401k Chalkboard & Retirement Plan – https://www.investmentzen.com/image-gallery

Toy figures/chart – https://www.freedigitalphotos.net/images/view_photog.php?photogid=2888

Money pile – https://www.flickr.com/photos/aresauburnphotos/

While I have years of successful financial & budgeting experience and run several million-dollar businesses and handled the accounting, P&L and been responsible for the financial assets of them, I am not an accountant or CPA. Like all my posts, my posts are my opinons based on my own experience, observations, research and mistakes. While I believe all my personal finance posts to be thorough, accurate and well-researched, if you need financial advice, you should seek out a qualified professional in your area.

As an Amazon Associate I may earn a small comission from qualifying purchases if you click to Amazon from my site and choose to make a purchase. You can read my complete affiliate disclosure for more details.