Many Americans struggle to get bigger paychecks

Since the economy began to struggle in 2008, many segments of society have lost ground or just tread water.

But it’s not all bad news and there ARE things you can do to change your habits, expenses, income, and yes, even get bigger paychecks.

To get bigger paychecks, 1st, make sure you aren’t paying too much in taxes. If you get a huge refund each year, that means you lent the government money interest-free. Adjust your allowances to get more take-home pay, but also get on a monthly budget & monitor how future raises can negatively impact your tax bracket.

The good news is there are steps you can take today to increase your paychecks tomorrow; without getting a raise. Bright Money can help, finding faster, smarter ways to save and set aside from your paycheck. It can also pay off your cards faster and save you money on interest charges.

In this post, we’re looking at all the ways you can cut expenses & improve your budget. But specifically, we’re looking at the key steps to take for bigger paychecks.

If you’re in the situation where you think refinancing student loans might make sense, the folks over at Next Day Personal Loan make it easy to get the best offers in under 2 minutes.

You could possibly save thousands a year and you have nothing to lose in checking!

The sad truth about the cost of living and salaries

In my own family, while I have changed employers we’ve seen our expenses go up roughly 46% across the board. But we’ve struggled to get bigger paychecks to keep up with the cost of living.

Healthcare alone for our very healthy family of 4 has gone up about 45% since 2008.

Meanwhile, our family’s annual salary has maybe gone up 9%. And even if we’re not the norm in that regard, as I get into more below, the average salary increase has only been about 2.2%/year.

So if your family was consistently getting those 2.2% increases since 2008 you’d have increased about 19%. What happens when salaries increase 19% but your costs increase 46%?

That’s right; less money for your family.

Bigger paychecks feel like a thing of the past

As I said, even for families that have done better than ours, available cash for purchases has decreased by 27%!

That’s not only affecting luxury purchases like vacations, new cars and appliances but also just the basic operations of the household.

When we as a country spend less, be it at the department store, grocery stores or vacation destinations, guess what? They cut back on staff and stock. Plenty of businesses have actually gone out of business.

So what happens to my household or yours affects EVERY household.

Do a monthly budget to feel like you’re getting bigger paychecks!

You know what happens when we do a monthly household budget? As Dave Ramsey says, “We tell our money where to go instead of wondering where it went”.

If you and your spouse do a written budget together, before the month begins, magic happens.

When you line up your monthly expenses and all sources of income you begin to see where $$ are being wasted.

When you start doing a budget it becomes easier to see . . .

- How much are you spending eating out (vs cooking at home)

- If you are wasting precious $$ buying coffee (on the way to work each day?)

- Do you constantly forget to plan for irregular expenses (like oil changes or annual auto registrations and then forced to put on a credit card?)

These things individually and on a daily basis may not seem like a lot. But if you buy a grande drip coffee at your local Starbucks 5 days a week 50 weeks out of the year, guess how much you’re spending?

Well over $600! Not enough to retire on for sure, but what else could you spend that on?

I’m not saying your life has to be without those little perks. But maybe Starbucks becomes your once a week treat and not a daily habit.

For less than $5.00/week you can easily brew your own and if you really need to feel fancy, just get a handy Starbucks travel cup for less than $10 bucks!

In addition to non-essentials, how much of your hard earned bucks are just going to pay off debt each month?

Household Debt Rises By $572 Billion, Ends 2017 At A New All Time High https://t.co/yI0HpMOtWc

— zerohedge (@zerohedge) February 13, 2018

Need help getting started on a monthly budget?

I have a copy of my Budgeting Spreadsheet available at no charge

– a key step in feeling like you’re getting larger paychecks!!

This is the very same spreadsheet my wife and I have used for about 7 years.

It’s a simple, highly customizable, Excel spreadsheet and you can download it quickly and easily FOR FREE!

If your family is struggling with your finances, I highly recommend you take a moment and read about how to stop Living Paycheck to Paycheck.

Our parents had bigger paychecks than we do

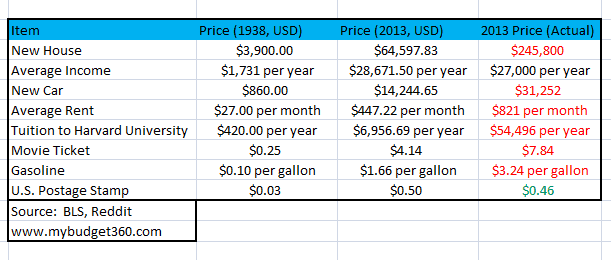

Take a look at this chart courtesy of Mybudget360.com.

You can see the actual cost of something in 1938. The middle column shows what that item should cost as of 2013 if it represented the same percentage of annual average salary as it did in 1938.

Then the far right column shows the actual average US price as of 2013.

Thus you can see indisputable proof that our paychecks are not growing nearly as fast as the cost of living.

Bills are getting larger faster than paychecks

Inflation has averaged just under 2% per year since 2008 according to Usinflationcalculator.com. According to the Social Security office, average wages have increased an average of 2.2% since 2008. A nominal increase for sure, but still an increase.

So why doesn’t it feel like things are getting better?

Well for one, if you look at the 8 years leading up to 2008, the average annual increase was 3.31%.

So right out of the gate, on average, we’ve seen our raises decrease each year since 2008 about 1.11%. So as your annual expenses continue to climb, your paychecks are actually going down by about $500/year.

Going back to 2008 up to the time of this post, that means the average American has lost around $5,000.

Wages & Salaries Growth has been declining for 30 years, meanwhile the illusion says everything is awesome. pic.twitter.com/TXWRXxuJqy

— StockBoardAsset (@StockBoardAsset) November 16, 2016

Is your tax bracket preventing bigger paychecks?

Most of us just try and do the best we can and hope for nice raises each year.

Unlike our grandparents, most households these days are 2 paycheck households. What we don’t always consider is the impact of moving up a tax bracket might have on our paychecks. For this example I’m using some tax rates courtesy of BankRate.

Let’s say John and Kris are married and currently make $72,000/year combined.

If Kris gets a $4,000/year raise, that bumps them from a 15% tax bracket to a 25% bracket. Back when they were making $72k, they were paying (using basic numbers and not looking at deductions) $10,800 in Federal income tax each year.

That left them with a net annual income of $61,200.

Now Kris is proud of that raise of $4,000! But now making a combined $76,000 per year, in a 25% tax bracket, they will now pay a whopping $19,000 in Federal income tax!

Guess what? That will leave them with a net annual combined salary of only $57,000!

So for all of Kris’ hard work, their combined annual salary will actually GO DOWN by $4,200!

So do the math and double check, but for your family, it just might make sense for one person to work less so you can have larger paychecks!

I recently had a guest post from writer Barbara Delinsky on the 7 most Common Tax Return Mistakes people make. If you haven’t seen it yet, it’s well worth checking out!

You can get bigger paychecks with just a few simple steps

5 tips to avoid penalties for failing to file your company’s income #tax return – By Viresh Harduth, VP: New Customer Acquisition (Start-up and Small #Business) for Sage Africa & Middle East. https://t.co/Bg9jDN1yEF https://t.co/oee7Y43oAp pic.twitter.com/sM8TEXZZxs

— Adam Fisher (@SageAdamFi) November 13, 2018

The first key is to look at the average size of your tax refund each year.

I know it feels awesome to get a refund that is thousands of dollars. But you know what feels better? Not giving your money to the government in the first place!

Think of it this way. If you get a refund of $5,000 that means you essentially lent the government $5,000 over the past 12 months and they didn’t pay you 1 cent of interest.

Do you know what happens if you owe the IRS money for 1 year? That’s right, not only do they demand it, but often you pay interest and penalties and they can even garnish your wages if you take too long to pay.

Still can’t quite get your budget to balance? Consider starting a Side Hustle to Earn Extra Money!

Lots of folks just like you make an extrta thousand or more a month with just a few hours of their prescious time; and many of those jobs can be done from home!

So why in your right mind would you want to lend them money for a year and get nothing?

Now if you routinely pay taxes come April 15th, this section of the post probably won’t help you much. But for most Americans, according to the IRS, you’ll get an average of over $3,000 back in the form of a tax refund.

If you didn’t get that $3,000 refund, guess what? Your paychecks would have been $250/month higher last year. That’s not enough to do a month long vacation in the Caymans or anything, but it’s something.

My family could definitely use an extra $250/month and I bet yours could too.

Interestingly enough, according to a recent poll by Bankrate, the higher the income level the lower the desire to get a large tax refund.

So what do the wealthy know that we don’t? Flipped a different way, how many of us simply use a tax refund as a way of saving because we lack the discipline to do it ourselves?

If you’re one of the millions of Americans using a tax refund as “forced savings” here’s a video why you shouldn’t https://t.co/IWRD4cAviO

— Michelle Singletary (@SingletaryM) April 10, 2014

So what do you do if you receive a large refund?

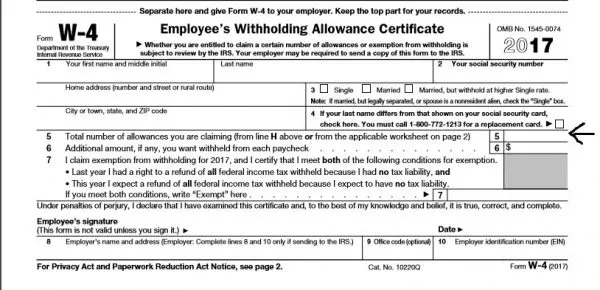

The best place to start is by adjusting the withholding allowances on your W4 form with your employer. I’m sure most of you reading this have filled out a few of those in your day, but if not, I’m talking about this form from the IRS:

Click on the form to download a copy from the IRS which you can print, fill in and give to your HR person at work.

So first it will be helpful to know how many allowances you are currently claiming. This will be shown on your paystubs, but when in doubt ask your payroll person. Often people just blindly put down a 0 or a 1 box 5 where I drew the arrow. In most cases, you’ll likely never want to enter anything in boxes 6 or 7.

In truth, you can put down any number you like in box 5. Of course, if you put a 45 there and end up owing a lot come April 15th the IRS might not like that, so let’s not get carried away.

Just know the smaller the number in box 5, the more your employer withholds for the IRS.

Want bigger paychecks? Make the number in box 5 larger

Let’s say you currently claim 3 allowances (normal if you’re married with 1 kid).

Come April 15th you find yourself getting a $3,000 refund. You could probably up your allowances to 5 going forward and most likely come out next year about even.

Even if you owe a small amount next year, isn’t it worth it to have had bigger paychecks each month?

I used to find in my personal experience that each allowance I added was worth about $50/month to my checks. But since I’m not a professional tax guy and am only telling you what has worked for me, I’d like to recommend a different approach.

TurboTax has a nifty W4 Withholding Calculator you can use to see EXACTLY how much you should be claiming.

So what are my . . .

3 Key Steps to Bigger Paychecks Tomorrow?

1. Do a monthly budget to make sure every dollar counts!

The budget is your key to financial freedom.

Without a budget that changes each and every month, you’re just guessing where your money is going to. On average, when people start to budget, they usually find they spend about 20% less.

2. Make sure your tax bracket isn’t preventing larger paychecks!

Sometimes more is less.

Depending on your current income an tax bracket, a small increase might actually push you into the next tax bracket. When that happens you’ll actually take home less than if you hadn’t gotten that raise!

I’m not, necessarily, suggesting you turn down that raise. But it is crucial that you know your tax bracket and know what the next threshold is so you can plan accordingly.

3. Check your w4 allowances and increase a little if you consistently get large refunds

A big tax refund just means you loaned the government money all year for free.

Trust me; if you owe them money for a year it ain’t free! So do yourself a favor and set your withholding allowances so that you come as close as possible to break even.

That means you don’t owe them much and they don’t owe you much.

A large refund sounds a whole lot better if you just get bigger paychecks throughout the year instead of 1 lump payment!

Did I cover all the bigger paychecks tips and strategies you were looking for?

In this post, we looked at the reality that many of us face; a significantly increased cost of living and stagnant wage growth.

We talked about the proven power of budgeting and exactly how our paychecks have gotten smaller over the decades. Specifically, though, we looked at the steps you can take to bigger paychecks and maximize the hard-earned dollars you’re getting.

What if your biggest financial challenge?

If you like this post, please follow my Tax board on Pinterest for more great tax and income tips from myself and top finance experts!

Of course in this legal age we live in, I do have to offer the following disclaimer:

While I have years of successful financial & budgeting experience and run several million dollar businesses and handled the accounting, P&L and been responsible for the financial assets of them, I am not an accountant or CPA. Like all my posts, my posts are opinions based on experience, observations, research, and mistakes. While I believe all my personal finance posts to be thorough, accurate and well-researched, if you need financial advice, you should seek out a qualified professional in your area.

Photo credits (that aren’t mine):

Empty Pocket by CafeCredit.com is licensed under CC BY 2.0

Destroying Money by eFile989 is licensed under CC BY 2.0

- Sagittarius Man & Gemini Woman Love and Sex Compatibility - January 31, 2024

- Taurus Ascendant Rising Personality Traits in Men (Guide) - January 31, 2024

- How to Seduce and Attract a Sagittarius Man (Seduction Tips) - January 31, 2024