Can’t pay the taxes you owe this year? Set up an IRS Payment Plan with these simple form 9465 instructions!

I think you’ll agree with me that worrying about taxes is incredibly stressful. Owing taxes is no fun. I’ve been there. Wondering when or if the IRS is going to come knocking is stressful.

Hiding your head in the sand doesn’t really give you peace of mind.

Most people have no idea just how easy it is to set up an IRS payment plan. And understanding IRS form 9465 instructions are the key to getting it done.

The media paints this evil, terrifying picture of the IRS. Not without good reason, but at the end of the day, they just want to get paid.

If you approach them in earnest and want to pay them, guess what? They are likely to say yes because that’s a whole lot easier than tracking people down, court orders, wage garnishments, etc.

You want to pay and they want to get paid. They have every reason to cooperate if what you propose paying is reasonable and somewhat timely.

So in this post, we’re diving deep into the world of the IRS payment plan.

We’ll explore the how, when, and why you might need to set one up. Then we’ll walk through exactly how to use their form 9465 instructions so you can get yours filled quickly and easily!

Looking for an easy, quick and free way to file your taxes online?

E-file Your IRS Taxes for FREE with E-file in as little as 15 minutes. Get your refund as fast as possible. If you run into trouble, quickly and easily get help with their online support team.

Learn more about E-file today!

Why an IRS Payment Plan is your best option

Ignoring the IRS when you have a large tax bill outstanding is a BAD idea.

While they do have to give you notice and you can file appeals, the IRS can take your home, car and/or paychecks.

You don’t want the IRS to come looking for you!

An IRS Payment Plan, filed using form 9465, gives you room to breathe. It means you’re not living in fear of the Internal Revenue Service knocking at your door or (worse) your place of employment.

Now if you make $200,000/year, owe $49,000 and want to take 10 years to pay it back, they’re going to say no.

That’s just not reasonable. But in most cases, if you owe a reasonable amount and plan to pay it back over a reasonable time within the next 6 years, they will say yes.

No penalties; just a simple interest rate of around 5%; likely better than you’d pay taking out a loan and certainly better than putting on a credit card.

So learning exactly how to file your payment plan using these form 9465 instructions is crucial!

Thinking about cashing out a retirement fund to pay the IRS? Think again!

Learn how to pay less in taxes next year by investing more into your tax deductible 401K w/my blog post https://t.co/HMWoaNWtBz pic.twitter.com/BeIo7fORu2

— Super Millennial (@supamillennial) March 23, 2017

Why cashing out retirement funds is your worst option

Unless you are age 59 1/2 years of age, when you cash out retirement funds (IRA, 401k, etc) for ANY reason, you’re going to pay your tax rate on that PLUS a 10% penalty.

For many of you reading this, that’s roughly 35%! Would you go borrow money at 35% interest to pay off debt? Especially when an IRS Payment Plan would generally charge you only about 5%?

No is the answer you were looking for.

That’s what makes cashing out your retirement plans one of the WORST options for paying off the IRS or any debt. Just follow my proven form 9465 instructions and you’ll be way better off!

Cashing retirement plans before age 59 1/2 should only be done under 2 circumstances:

- To avoid foreclosure on your home

- Preventing bankruptcy

Any other cashing out of retirement funds is just dumb. And I say that having done it once myself close to a decade ago. I was dumb. Learn from my mistake!

If you need help with your retirement planning and don’t know where to turn, I highly recommend checking out my 9 Best Ways to Save for Retirement & Make Your Dreams Come True! post. It’s a great place to get started with all the basic info you need.

Why simply filing an extension doesn’t work

An extension simply lets you file late.

If you owe the Internal Revenue Service money, it’s still due by April 15th. All you’ve done by filing an extension when you owe money (even if you don’t know you owe) is create penalties and interest.

If you know you owe, you need to set up an IRS Payment Plan by April 15th by following these form 9465 instructions.

Aren’t sure you will owe?

Then you need to figure that out before April 15th. If you don’t know how to calculate that seek out a CPA or other tax professional or use any one of the free or low-cost online options.

Worried about your tax return? Make sure you check out my 7 Common Tax Return Mistakes post which covers the most common tax errors out there and the easiest ways to fix or avoid them!

What criteria must you meet to set up an IRS Payment Plan?

You must owe less than $50,000 in total outstanding taxes (including penalties & interest) to set up an IRS Payment Plan following the form 9465 instructions.

They refer to this as an “online payment agreement”. However, even if you owe more than that, it is still possible to file a request for installment payments for a shorter term.

You also need to be current on filing taxes so if you are years behind you have some work to do first.

If you are years behind and work for an employer that has been withholding taxes, chances are you don’t owe much. Otherwise, you would have been tracked down by now.

So file your back returns, take your lumps and then see if you need to set up an IRS Payment Plan for the current year using the form 9465 instructions.

Lastly, you must be able to pay what you owe in 6 years or fewer.

Also be aware that any future tax refunds you may get will go right towards your debt, not to you. Thus you may want to up your withholding allowances a little to minimize the size of the refund.

That’s a better strategy generally anyway; why let the IRS keep thousands of your dollars all year instead of having larger paychecks?

Looking for more ways to keep more of your hard-earned dollars and avoid giving it to the IRS? Check out my 11 Proven Tips to Get Your Biggest Tax Refund This Year which details all the simple steps you should take to keep more of what you earn.

What are the costs involved in following the form 9465 instructions?

I get there’s something wrong about the idea of charging people a fee to pay money they can’t afford to pay.

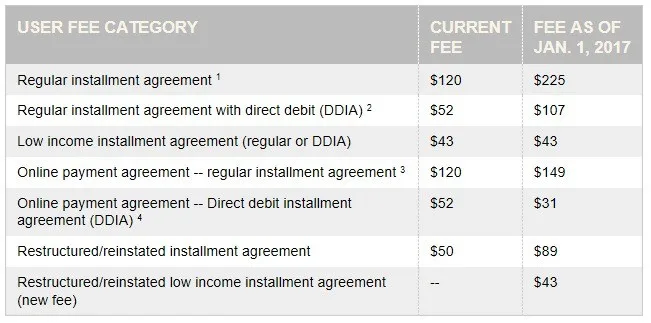

But hey; it’s the Internal Revenue Service. What are you doing to do? Pay. Below is a current chart of their fees as of a few months ago.

As you can see, for most of you who meet their “online payment agreement” criteria, especially if you opt for the direct draft out of your checking account, you’re looking at a fee of $31.

While I’m not a fan at all of giving most creditors direct access to your checking account, since the IRS can take it anyway, this is your best and cheapest option.

If you don’t meet the OPA criteria but are doing the installment plan option, you’re likely looking at $107 if you do the direct access.

If you struggle with credit issues and past due debt in general, I highly recommend you take a moment and check out my highly shared post about Credit Report Repair Steps.

How do you set up an IRS Payment Plan?

If you owe less than $50,000 simply click the IRS “Apply for an Online Payment Agreement for Individuals and Businesses” page to get started.

You’ll need the following info to get started:

- Name

- Valid e-mail address

- Address from most recently processed tax return

- Date of birth

- Filing status

- Your Social Security Number

If you and your spouse filed a joint return, whoever has their social listed first is the one who will need to apply.

Owe more than $50,000 and need to set up the installment version of an IRS Payment Plan?

You’ll need to fill out and mail both a Form 9465 – Installment Agreement Request and a Collection Information Statement then call 800-829-1040 to go through the next few steps.

Check out this IRS video that details much of the above info!

What are the specific form 9465 instructions?

First, if you are filing form 9465 with your tax return, just mail the two together. If you are mailing it separately (more likely), then refer to this IRS list to see where you need to mail it.

Use Form 9465 if you’re an individual:

- Who owes income tax on Form 1040

- Who is or may be responsible for a Trust Fund Recovery Penalty

- Who owes employment taxes (for example, as reported on Forms 941, 943, or 940) related to a sole proprietor business that is no longer in operation

- Who owes an individual shared responsibility payment under the Affordable Care Act. See section 5000A.

Don’t use Form 9465 if:

- You can pay the full amount you owe within 120 days (If you plan to pay the taxes, interest, and penalties due in full within 120 days, you can save the cost of the setup fee.

- You want to request an online payment agreement (see Applying online for a payment agreement above)

- Your business is still operating and owes employment or unemployment taxes. Instead, call the telephone number on your most recent notice to request an installment agreement.

You can see the complete list of IRS form 9465 instructions here or check out this helpful video.

Looking for an easy, quick and free way to file your taxes online?

E-file Your IRS Taxes for FREE with E-file in as little as 15 minutes. Get your refund as fast as possible. If you run into trouble, quickly and easily get help with their online support team.

Learn more about E-file today!

Do you need help with the form 9465 instructions?

In this post, we took a detailed look at the IRS payment plan.

We explored why you might need one, how it’s different than filing an extension and why you definitely don’t want to just not pay or file late.

Specifically, though, we walked through all the form 9465 instructions on how to get yours filed quickly and easily so you can stop the worry and fear that can sometimes come with not being able to pay our taxes on time.

If you like this post, please follow my Income Tax Tips board on Pinterest for more great tips from myself and top tax experts!

Of course I have to offer the standard disclaimer here: I am not a tax professional and you should always seek the advice of a CPA or other tax professional. While I do have decades of experience running million dollar businesses and have many years of personal experience with taxes, ultimately, the opinions offered here are mine based on my personal experience, knowledge and research and should not be interpreted as legal or financial advice.

Photo credits (that aren’t mine or which require attribution:

Considering The Tax Shelter By: JD Hancock is licensed under CC BY 2.0

- Sagittarius Man & Gemini Woman Love and Sex Compatibility - January 31, 2024

- Taurus Ascendant Rising Personality Traits in Men (Guide) - January 31, 2024

- How to Seduce and Attract a Sagittarius Man (Seduction Tips) - January 31, 2024