Talking about money as a couple is is hard, whether you are recently married, not married yet or have been together for years. If you haven’t thought about it yet, consider financial marriage counseling to help strengthen your marriage.

Here’s what you need to know:

Financial marriage counseling combines traditional marriage counseling with financial planning & education. It gets both spouses on the same page with money and fosters good communication. With money as a top reason for divorce, a good financial marriage counselor may mean the difference between success & divorce.

Research shows that, of 3,010 survey participants, nearly 70% admitted they would rather reveal the truth about how much they weigh than how much money is in their bank accounts.

“A financial marriage counselor will help you both make a plan of action for saving money and getting out of debt. They can help you with saving on unessential costs, save on taxes, help you answer questions like is it better to claim 1 or 0 to deduct your taxes and straighten out your spending, saving, and debts.”

It can also help you get on the same page about spending and borrowing money.

While money is not necessarily the number one cause of marital conflict, it is usually in the Top 3 Reasons for Divorce (click to read my article on this site). Reason #1 is easy to understand, but I was really surprised by reason #2.

So today, we’re diving in deep into the world of financial marriage counseling. We’ll explore what it is, how it can help, and what they do while you’re there.

Specifically, though, we’re exploring exactly why financial marriage counseling could not only help but maybe even keep your relationship from failing.

If you don’t have a current copy of your credit report, then we’re just shooting blindly in trying to raise your credit score.

Luckily, myFICO can get you access to your credit score and a copy of your credit report from all 3 credit bureaus (Equifax, TransUnion, and Experian)!

But myFICO does more than just get you a credit report. With their credit simulator, you can see how possible financial choices will affect your credit score in the future!

Get your 3 bureau report today and save 20%!

Learn more over at myFICO and get started today (just click the link to see all the details on their site).

co-authored with Rachael Pace, marriage and relationship in conjunction with Jeff Campbell

70% of married couples argue about money more than anything else. It’s an issue, so how do we deal with it? I’m tackling this head on in today’s episode.

A new episode of The Rachel Cruze Show launches today at 12 PM EST! pic.twitter.com/CZaKffifPl

— Rachel Cruze (@RachelCruze) July 16, 2018

Should married couples share money?

Married couples should combine all financial accounts including bank accounts. When couples live separate financial lives, they eventually begin to live other aspects of their lives separately too. Divorce rates are almost twice as high for couples who do not share bank accounts.

(source)

You didn’t say “I do” but only under certain conditions. You agreed to a union; a joining. By definitely, what was mine or yours becomes “ours”.

Who makes more money or who has more debt becomes irrelevant.

That doesn’t mean, however, that it’s OK for one spouse to bring significantly worse financial baggage into the marriage and expect the other to deal with it.

Ideally, before getting married, both would-be spouses would sit down and discuss their finances; the good, the bad, and the ugly.

Both would disclose things like:

- Their income

- Total outstanding debt including student loans

- How many bank and credit accounts they have

- If they owe family or other people money

Once clear, then a good financial marriage counselor can help the couple come up with a plan of how to move forward.

Some couples won’t want to combine their income and bills.

They might feel like it’s “theirs’s” or they may not want to be accountable to their spouse for how they spend their money. These people should NOT get married. If they are that selfish and secretive about money, they aren’t likely going to be saints in other ways either.

I go much further into how, when, and where couples should combine their finances in this article.

In it, I also get into the extremely high and surprising statistics about how NOT combining finances plays into divorce rates.

In this video, we discuss 7 bad money problems that you should be avoiding in your marriage.

⬇️⬇️⬇️⬇️⬇️https://t.co/58cmJC4pup pic.twitter.com/6TUnyfvmaE

— His and Her Money® (@HisandHerMoney) November 24, 2020

How can we solve money problems in marriage?

To win financially in a marriage, combine all bank accounts, have a monthly budget that both spouses agree to, have an agreement that neither spouse will make financial agreements without consulting the other, and agree to spend less than the total household income.

Money problems fall into one of 3 categories

- An income problem

- Lack of a plan

- A spending problem

Make no mistake, some couples face all 3 of these. But if your marriage is struggling financially, it’s almost assuredly one of these 3 things at the root of it.

An income problem is fairly explanatory.

We know that the average household income in the US is just shy of $60,000. Obviously, if you live in New York or California, that is even higher.

So if your household income is significantly below that, we need to come up with a plan to change careers, get additional education or certifications to broaden career options, or possibly move to have better opportunities.

If income isn’t the issue, it could be spending.

A monthly household budget is a must for all families. It helps ensure that every dollar you take in gets assigned exactly where it needs to go. It also helps ensure you aren’t spending more than you make (that only works in government).

One thing that works really well if overspending is a problem in your house is to implement the 3-day rule. Essentially this means putting in place an agreement on waiting 3 days on any major purchase.

That allows you and your spouse time to really decide if you need it, and it will help with overspending.

If overspending sounds like your problem, and especially if you are in both of those boats, check out this post about how to budget on a low income.

In it, I walk you through the exact steps my wife and I took in that boat, including the 1 move that really allowed us to get real traction in paying off our debt and living the life of our dreams.

Lastly, many couples just go through financial life blindly.

They earn, they spend, they hope it balances out in the end. They use credit cards when it doesn’t and they make those minimum payments and just go along like that year after year.

The problem with that is that they are usually just 1 emergency away from financial disaster. One of them loses a job, or gets in a serious car wreck, and life comes crashing down.

A good financial marriage counselor can help you create a plan, get on a budget, and start an emergency fund (click to read my guide on how to set one up). I have 1 tip in there that can get you building that fund way faster than you ever thought possible!

Dave Ramsey says: Dave Ramsey: Married or single, budgeting is the key https://t.co/v85x3okbue #familybudget #money #family #marriage #parenting pic.twitter.com/0kCiIB27lc

— Parenting At Home (@ParentingAtHome) November 21, 2017

How do you deal with finances in a marriage?

The best steps to take to win with money after getting married include:

- Combine all bank accounts

- List one another as beneficiaries on all life insurance and retirement accounts

- Full disclosure on any debt, collections, or judgments

- Agree to pay off each other’s separate debts as if it was incurred together

- Create a monthly budget that both spouses agree to in advance

- Include an agreed-upon spending budget for each spouse in the budget that each can use as they wish

- Don’t make any financial decisions without consulting your spouse

- Spend less than you make

- Budget money every month to go into retirement accounts

Honestly, there’s a lot more than those steps.

But if you get those steps down, you’ll be way ahead of most couples and you’ll avoid the money fights that plague most marriages.

Are You Guilty of Financial Infidelity? https://t.co/SLXc0LvUrf via @thedebtshrink1 pic.twitter.com/JcUd6V3mZm

— Brian (@FinLitBrian) February 19, 2019

What is financial infidelity in a marriage?

Financial infidelity is when one spouse makes an intentional decision to be dishonest about something related to the couple’s finances. Examples include a secret credit card or loan, hiding debts, or making large purchases without consulting the other spouse.

And just like regular infidelity, the effects of financial infidelity can be devastating.

Trust is broken, tensions flare, and that’s all on top of the financial burden created by the financially-unfaithful spouse.

And as with sexual infidelity, marriages can and do break up over this type of behavior. But unfortunately for the victim, the debts incurred often remain joint debts if the couple is legally married, even if the debts are only in the other spouse’s name.

But even when financial infidelity isn’t a dealbreaker, it can still take years to recover the love and trust that was lost in the disclosure.

So the best policy is always to make all financial decisions together, and if you do make a mistake (which you will), own it right away and take the necessary steps to fix it.

Millennials most likely to commit financial infidelity: survey https://t.co/RubsNubTXz by @SibileTV pic.twitter.com/paDhgpKwLd

— Yahoo Finance (@YahooFinance) February 7, 2020

So let’s review the . . .

7 Proven Ways Financial Marriage Counseling Can Help You

1. Building Trust Through Open Communication

Like regular marriage counseling, financial marriage counseling will help you and your partner learn how to talk to each other about money.

Just how awkward is it for couples to talk about income and spending?

One recent survey done by Aspiration found that of the more than 700 participants, only 52% of men and 60% of women tell their partner how much money they make.

Your financial advisor will help you both learn how to talk to each other about your spending, budgeting, and financial goals.

Studies show that students who grew up in households where money was spoken about openly were less likely to have problems with overspending and had less credit card debt.

The lesson? Talking openly with your partner about financial issues can boost trust in your marriage while reducing your debt.

In any form of communication, learning Empathetic Listening Skills (click to read now on my site) can really help. It ensures the speaker feels heard and validated. In fact, one of these techniques in my post may literally have saved my marriage.

Financial Marriage Counseling #Counseling #Financial #healthinsurance #insurancenews #insurancequotes #lifeinsuranceupdater #Marriage #wealthmanagement https://t.co/1EXDqNVmET pic.twitter.com/lK94Sfi8Og

— Hai Yen (@haiyencutelam) February 12, 2019

2. Eliminating the Devastating Effects of Financial Dishonesty

Sometimes, it’s hard to be honest about money.

Finances are inherently embarrassing. They can be especially awkward if you have some debt or trouble with impulse purchases.

Did you know there is actually a term called ‘Financial Infidelity’?

No, this phrase does not refer to couples spending money on their secret lovers. Instead, it refers to one spouse opening up a secret bank account so that they can use it for personal spending that they don’t have to inform their partner of.

This is just one way in which you may be lying to your partner about your spending.

Over-charging credit cards, gambling, the exact amount of money you are making, lying about unpaid bills, and shopping addictions are other areas of a couple’s financial truths that they may lie about.

Seeing a financial counselor can help you and your spouse learn how to be honest about your spending habits so that you can correct any debts you have and strengthen your marriage.

3. Helping You Get on the Same Page

If you and your spouse had completely different upbringings or socioeconomic backgrounds, you may have opposing views on money.

In order to have a successful financial married life, you and your partner need to get on the same page.

Having similar views on debt and spending is crucial. Your counselor will help you understand how each other thinks about money and to make a financial plan that satisfies both of your points of view.

4. Showing the Crucial Importance of Combining Finances

Financial marriage counseling is not simply for those who are already in debt or who are mismanaging their money.

Getting on the same page with your spouse about money is crucial! Dave Ramsey, renowned financial guru, recently conducted a study on marriage and finances.

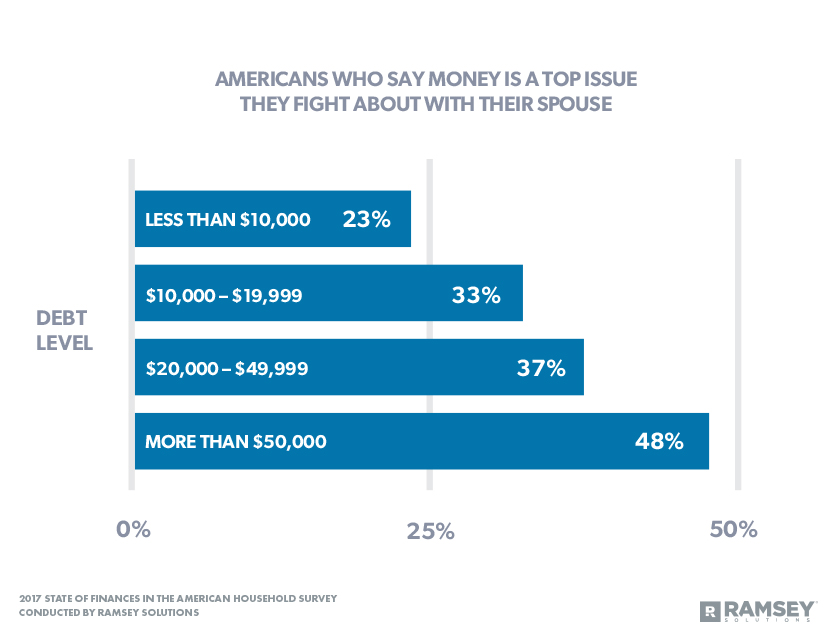

In that, he found that “couples who fight about money have roughly $30,000 in consumer debt on average, with nearly two-thirds (63%) of all marriages starting off in the red.”

He also found that more millennials are bringing debt into the marriage compared to older generations, citing that “Forty-three percent (43%) of couples married more than 25 years started off in debt, while 86% of couples married five years or less started off in the red—twice the number of their older counterparts.”

This is a problematic statistic that can leave many couples arguing over their finances once they are married. Combat this early by going to a financial advisor while you are engaged.

Financial marriage counseling will help you discuss:

- How bills will be split

- The importance of combining bank accounts

- How properties will be divided

- Advice on mutual investments

- The pros and cons of combined money management

- Many couples who are about to get married make the wise decision to visit a financial advisor to help them decide the best way in which they can combine their monies.

Ultimately for a successful marriage, you should combine finances.

That means combining all credit cards and bank accounts. Speaking of bank accounts, for real financial success, it’s actually crucial to have at least 5 different bank accounts (click to read now on my site).

Having multiple bank accounts can really make a big difference, so check out my article and see the 5 I think you must-have for financial success.

Combining finances also means all paychecks are no longer “yours” or “mine”, but “ours”.

Combine all income and expenses, make financial decisions together and you’ll be well on your way to financial and marital success.

FREE resources for #couples at every stage on our website. We break them out by years of marriage. Talking about money may not sound fun, but it’s critical for a marriage to thrive. Let’s stop “money” from being the #1 reason people cite when they #divorce. #loveandmoney pic.twitter.com/uimQpAailp

— The Money Couple (@themoneycouple) October 27, 2018

5. Helps You Avoid Crushing Debt Problems

A survey reported on by The Washington Post found that 33% of Americans hold debt that is currently in collections.

Another study reports that 8 in 10 Americans have debt of some sort, with mortgages being the most common.

The point? Most people have some sort of debt that they’ve accumulated over time, which means that most married couples do, too.

Having debt should not be embarrassing or something you lie about to your spouse. Instead, make it something you work on together.

Bringing debt into a relationship is going to scream trouble for your relationship satisfaction and your bank account.

By attending financial marriage counseling, couples will be able to tackle harmful debt in a positive way.

Struggling with living Paycheck to Paycheck? (click to read now on my site)

I highly recommend you take a moment and check out one of the most popular personal finance posts on the Middle Class Dad website. I get into several solutions, but 1 really surprising one added over $100/month to our budget.

6. Create a Budget Together

A study done at Columbia Business School found that people were more likely to deposit money into their savings after they publicly announced their goals to save more money.

This is partly because people feel more pressure to follow through on a commitment when they are accountable to someone else.

By openly sharing goals about financial saving or paying off debts, you and your spouse will be more likely to follow through on your financial plans.

Want the best budgeting tool out there? Download my FREE Excel household budget template now!

Once you get it, you can dive deep into how to use it and why it works in another post about why this is the Best Excel Household Budget Template (click to read now on my site).

7. Helps Ease Stress

One thing a financial marriage counselor will do is help you make a complete listing of your income, debts, and living expenses.

This is important if you are considering bankruptcy as a couple or are feeling undue stress financially.

Your counselor will also help you make debt-reducing proposals, create a budget, and help you communicate about your finances.

It’s almost impossible to have a happy marriage when you’re both fretting over finances.

It’s no surprise that money, or lack thereof, can put a large amount of stress and anxiety into a marriage. By going through financial marriage counseling, you will greatly ease your burdens.

Not sure of the cost or what they do in Marriage Counseling? Or wondering if it’s too late to save your marriage? Check out one of the most popular relationship posts on the Middle Class Dad site.

Did we cover everything you wanted to know about financial marriage counseling?

In this post, we reviewed the most common financial pitfalls that couples have.

Specifically, we reviewed the best ways that financial marriage counseling can help couples move past the turmoil, strife, and tension. This can set couples up for long-term success both financially and in their relationship as a whole.

What has been your relationship’s biggest money challenge?

If you like this post, please follow my Budgeting board on Pinterest for more great tips from myself and top financial experts!

About the co-author of this post.

Rachael Pace is a relationship expert with years of experience in training and helping couples. She has helped countless individuals and organizations around the world, offering effective and efficient solutions for healthy and successful relationships.

She is a featured writer for Marriage.com, a reliable resource to support healthy happy marriages.

Want to write for Middle Class Dad too? Check out everything you need to know on my Guest Blog Page.

While I have years of successful financial & budgeting experience and run several million-dollar businesses and handled the accounting, P&L and been responsible for the financial assets of them, neither Rachel nor I am an accountant or CPA. Like all my posts, my posts are opinions based on experience, observations, research, and mistakes. While I believe all my personal finance posts to be thorough, accurate and well-researched, if you need financial advice, you should seek out a qualified professional in your area.

- Sagittarius Man & Gemini Woman Love and Sex Compatibility - January 31, 2024

- Taurus Ascendant Rising Personality Traits in Men (Guide) - January 31, 2024

- How to Seduce and Attract a Sagittarius Man (Seduction Tips) - January 31, 2024